Today second estimate of US fourth quarter GDP will be released at 12:30 GMT.

After FOMC refrained from hiking rates yesterday and said will closely monitor upcoming data, with special focus to inflation, participants are likely to turn their attention to today’s GDP number, which is first flash estimate.

Past trends –

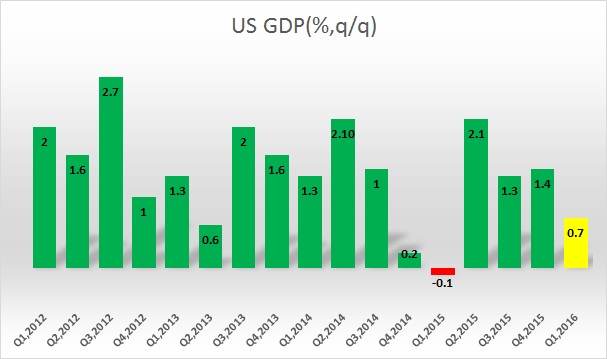

- US GDP picked up pace since 2013 and increased pace in 2014. However after rising 5% and 2.2% in previous two quarters, US GDP shrank by -0.1% in the first quarter of 2015. Historically speaking US economy usually falters in first quarter.

- Second quarter was relatively better, with GDP growing at 2.1% in second quarter from the first.

- Growth has slowed further in third quarter, with GDP growing about 1.3%.

- Final quarter GDP was much better than expected at 1.4%, still meager compared to 2014.

Expectation today –

- Economists are expecting GDP to slow down further and grow only by 0.7% in first quarter of 2016.

- However 0.7% growth isn’t bad, considering first quarter usually to be the worst in the year.

Market impact –

- US economy is largely expected to weaken, but if the number drops in negative, it might steal away recent equity rally and Dollar might drop hard. However weaker but positive number above 0.5% may not make much of a difference.

- However, if data do surprise on the positive side then it has higher potential to be a market mover. Any number above 1% would push U.S. equities higher and make Dollar stronger.

In latter case much of the Dollar strength may come from Euro and Pound, since Yen is occupied with BOJ shocker.

Dollar index is currently trading at 93.85, down -0.56% today, largely due to more than 3% gain in Yen.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX