China and Japan are the largest economies in Asia and currency movements in these countries are likely to have crucial implications for the whole region. Most Asian currencies are managed floats, but a few pegs remain in Hong Kong (HKD), Singapore (SGD) and Vietnam (VND). The mere fear of devaluation of the CNY is building pressure on the remaining currency pegs and managed regimes. The persistent depreciation pressure on the CNY and the BoJ's negative interest rate strategy, which led to an immediate sharp JPY weakening, have reinforced the concerns about competitive devaluation.

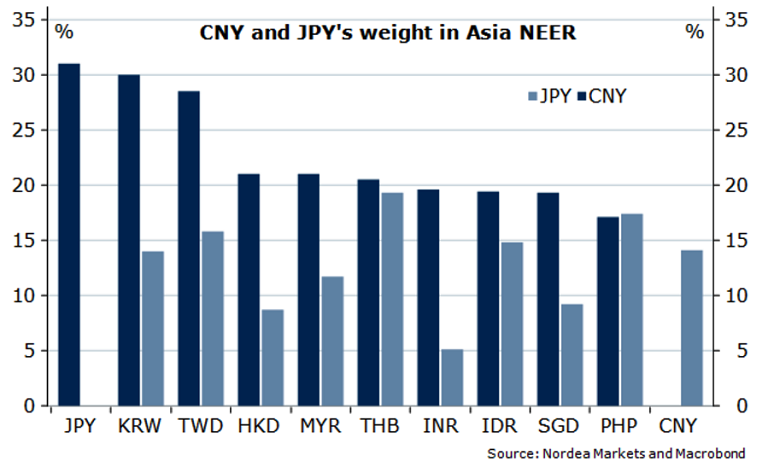

A modest weakening of the CNY is seen this year, but fears of a massive weakening of the CNY have already put pressure on the HKD and more pressure is likely if the CNY starts weakening again. The depreciation in itself is not a concern for the authorities but risks of intensifying capital outflows that could lead to instability in the domestic financial markets. Compared to the JPY, the CNY is more important for most Asian currencies in trade-weighted terms. Indeed, China accounts for around 30% of the trade-weighted JPY, KRW and TWD and for around 20% of the others. In comparison, the JPY accounts for about 20% of the THB, 17% of the PHP and 15% or less of the remaining currencies.

Hong Kong's HKD is in a difficult situation, slipped to the weakest level since 2007 in January. The country's close economic ties to the slowing Chinese economy and the currency peg to the USD have weighed heavily. Speculation has mounted about a break of the peg, but barring a massive CNY weakening, analysts see relatively low risk that the peg will break. Hong Kong's Monetary Authority holds USD 347bn in FX reserves, among the top ten in the world, and definitely has the ability to defend the peg. However, a massive weakening of the CNY would change the situation for Hong Kong. The HKD would be stronger in trade-weighted terms, the cost of keeping the peg in place in terms of higher domestic interest rates would increase the risk of a collapse in the red-hot housing market and capital outflows would likely increase significantly.

"There is a relatively low risk that the HKD peg will break in the near term. However, the larger the scale of the CNY weakening, the larger the likelihood that the HKD will be devalued. Larger-scale CNY weakening would likely lead to larger-scale weakening of most currencies in the region", notes Nordea Research in a report.

The PBoC stands ready to go to a great length to avoid excessive CNY depreciation. However, the sharply falling FX reserves in China (by USD 700bn to USD 3.3tn at the end of 2015) have raised doubt about the PBoC's ability to continue intervening. Since top levels reached in the summer of 2014, 19% have been lost. China is required to hold at least USD 2.7tn in reserves to live up to the IMF's recommendation. This puts a limit on how much direct FX intervention the PBoC can do. Hence, the PBoC is likely to continue relying on capital controls to mitigate outflows and ease depreciation pressures and would only consider devaluation after exhausting all other options.

"An increasing number of observers now think that a very large depreciation step is the best and only possibility of ending the PBoC dilemma. I am not sure whether the PBoC will have the courage to do that, however." said an economist at Commerzbank in a report.

CNY devaluation fears adding pressure on EM currency pegs; will it trigger competitive devaluation?

Tuesday, February 9, 2016 11:53 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand