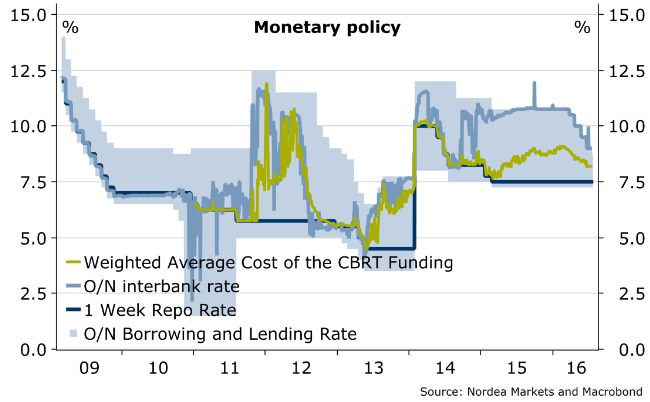

The Turkish central bank’s Monetary Policy Committee on Tuesday decided to lower the upper end of its overnight corridor – the overnight lending rate - by 25 basis points to 8.75 percent. This was CBRT’s fifth straight rate cut. It kept the repo rate unchanged at 7.5 percent.

In its policy statement, the central bank mentioned that the favorable developments in the terms of trade and the moderate course of consumer loans contribute to the recovery of the current account balance. It stated that domestic demand is positively impacting the economic growth, while exports are being underpinned by demand from EU nations.

According to the central bank, economic activity shows a moderate and stable course of growth. The Committee noted the implementation of structural reforms might significantly contribute to the potential growth. Meanwhile, the Committee has suggested that inflation might accelerate markedly in the short term because of developments in prices of tobacco and unprocessed food. Moreover, the trend of core inflation is likely to rebound gradually.

The CBRT, in its statement, mentioned that its future monetary policy decision would depend on the outlook of inflation. According to the statement, “taking into account inflation expectations, pricing behavior and the course of other factors affecting inflation, the tight monetary policy stance will be maintained”. The central bank stated that it will keep a close watch on market developments and that it will continue to take necessary liquidity measures to underpin financial stability.

The Turkish central bank’s move indicates its resolve to bring interest rates down and therefore to follow President Erdogan’s advice, stated Nordea Bank in a research report.

CBRT lowers upper end of overnight rate corridor by 25bps

Tuesday, July 19, 2016 12:35 PM UTC

Editor's Picks

- Market Data

Most Popular

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty