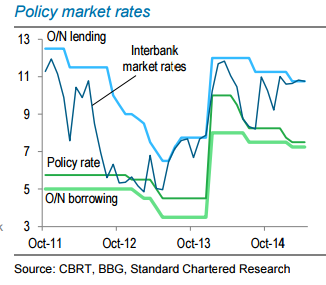

The central bank of Turkey has sent official signals of an easing cycle (cutting the policy rate then all rates on the corridor, MPC communiqués that emphasise the downward CPI trend justifying the easing), while becoming increasingly alarmed at the pace of TRY depreciation, resulting in de facto tightening that has pushed interbank market rates to the top of the interest-rate corridor (10.75%).

This has muddied broad monetary policy visibility and complicated market activity and perception. Rapid TRY depreciation amid weak growth starts a vicious cycle: the CBRT is tempted to ease policy to support growth, and as the TRY depreciates with each cut, it depresses GDP growth drivers even more.

Indeed, there is a high correlation between TRY depreciation and consumer confidence (final consumption is about two-thirds of GDP), while on the corporate side, addressing the supplementary costs of the FX mismatch means that companies divert some of their resources away from investment.

"We think the CBRT will leave the three interest rates unchanged at tomorrow's MPC meeting and might tweak (after recent remarks flagging such changes) the reserve option coefficients and/or required reserve ratios (to adjust the FX/TRY liquidity), but these measures have proven to have only marginal effects" said Standard Chartered in a report on Tuesday

In the current environment their is a possibility of 180-degree policy change, with a rate hike in the coming months, if politically induced jitters do not abate soon.

CBRT likely to take TRY’s poor performance into account

Tuesday, April 21, 2015 12:43 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX