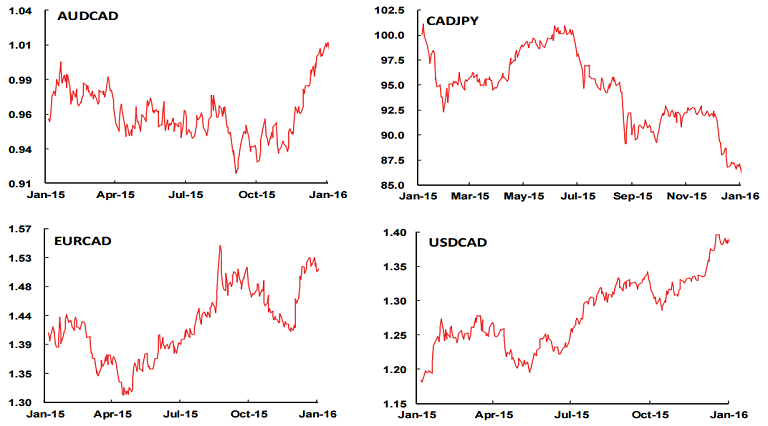

Of all the G-10 currencies, the Canadian dollar was hit the hardest in 2015, dented by firmer US interest rates, weaker oil prices and sluggish domestic data. The loonie lost over 15% of its value versus the U.S. dollar, Japanese Yen and British pound. The CAD sell-off was so severe that it drove USD/CAD to a 12-year high, levels not seen since 2004.

2015 was an extremely difficult year for Canada, and the negative factors noted above still remain intact supporting arguments for more CAD weakness in the weeks ahead. Interest rate differentials for US/Canada 2-year government bonds have widened to around 60bps, the biggest yield advantage for the USD since 2007. While spreads remain wide, or widen further, the USD is unlikely to backtrack.

The risk is clearly geared towards more CAD weakness, USD/CAD is likely to strengthen significantly in the early stages of the calendar year. 1.42/1.45 levels for USD/CAD should not be a surprise before the end of Q1 before some consolidation sets in through Q2/Q3.

"We continue to favour USD/CAD long positions from a short-to-medium term perspective but we also think the CAD is starting to look relatively attractive against some of its major currency peers where relative monetary policy (EUR) or value (AUD) considerations suggest the CAD looks a little more attractive now", says Scotiabank in a research note.

The Bank of Canada is expected to remain on hold at the late January policy meeting, the market is pricing in only a 25% probability of easing in March.

Governor Poloz's believes that stronger U.S. growth, a weaker Canadian dollar and rate cuts delivered in the first half of 2015 will help the economy recover and avoid the need for unconventional policies such as quantitative easing. But the market will approach the decision cautiously and the CAD may still find itself slipping if the central bank sounds dovish in its outlook for the economy. At the time of writing USD/CAD is trading at 1.4090 levels as at 1100 GMT.

CAD sell-off to continue through Q1 2016

Wednesday, January 6, 2016 11:42 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed