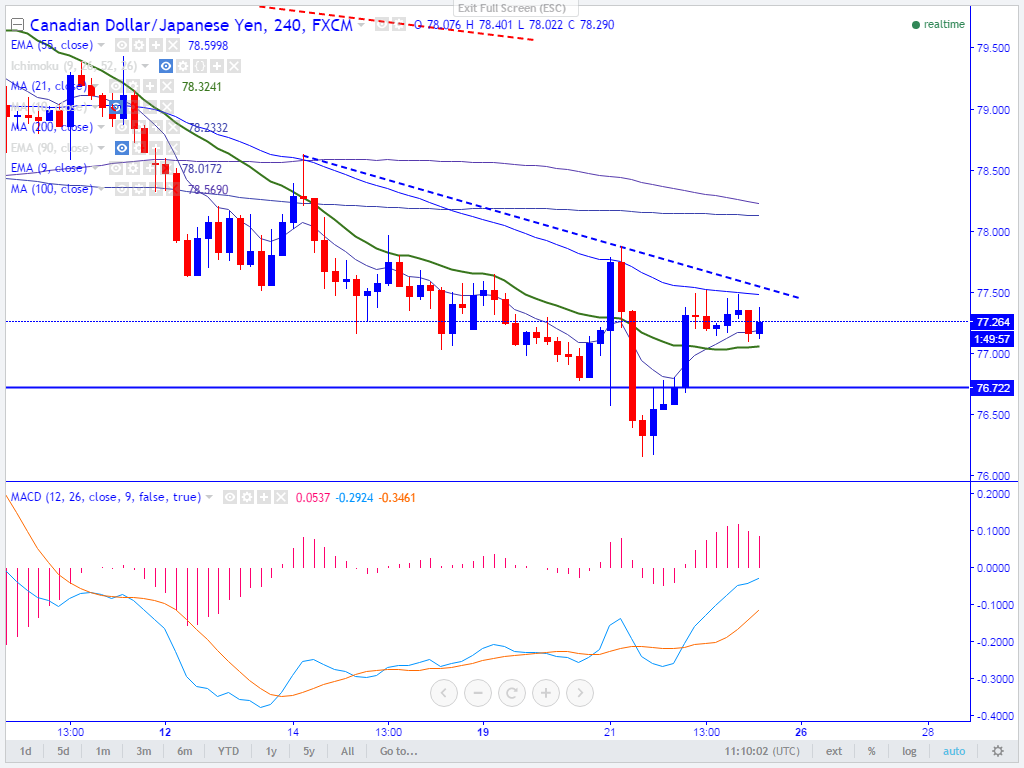

- Major resistance – 77.60 (trend line joining 78.63 and 77.88)

- Major intraday support- 77 (21- 4 H MA).

- The pair has pared its losses after making a low of 76.15 on Wednesday. It is currently trading around 77.19.

- In the four hour chart, the pair is struggling to close above 55- 4 HMA and also above trend line resistance .Any further bullishness can be seen only above that level.

- Any close above 77.60 will take the pair till 78.13 (200- 4H MA) /78.88 (61.8% retracement of 80.31 and 76.59)/80.47 (100- day MA).

- On the lower side, any break below 76.10 will drag the pair further down till 75/74.55.

It is good to sell on rallies around 77.50-55 with SL around 79 for the TP of 76.10/75

Resistance

R1-77.60

R2-78.13

R3-78.88

Support

S1-76.10

S2-75

S3-74.55