While Sterling is shivering with the fear of Brexit, You can’t see any sign of that in the credit market. In fact Gilts have outperformed its global peers, both Germany and United States this year. So, is credit market is mispricing the possibility of Britain’s exit from the union.

Definitely No.

First, Britain, unlike Euro Zoe countries can issue as much sterling as it wants, so as of now there is no credit risk associated with Britain’s exit from the Union.

Second, if Brexit occurs, a flight to safety would be positive for the Gilts, which will see the yields depress further.

Third, in the event of an exit, Bank of England (BOE) may have to cut rates, which would again be positive for the Gilts. Even if it doesn’t cut, hikes would be pushed back, positive for Gilts.

Fourth, Brexit fear has postponed lots of investments, which are getting parked to the safety of Gilts.

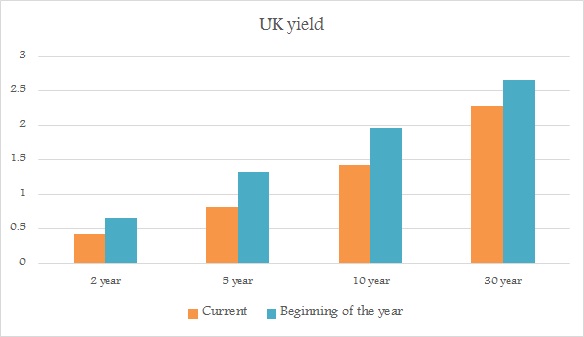

Fifth, despite 50 basis points yield compression in 10 year gilt this year, they offer attractive rates of interest, compared to Euro Zone partners.

So, only risk for the gilt we suspect is not an exit, in which case, run for risky assets would hurt Gilts and lead to rise in yields.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX