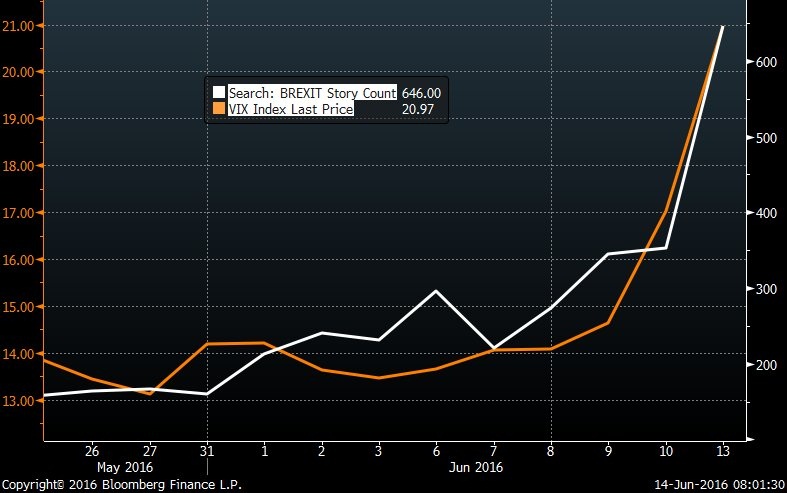

Yet another evidence that the fear surrounding Brexit is fuelling the risk aversion in the market. The chart was shared this week by Aurelija Augulyte, a senior FX strategist at Nordea Markets. It shows the relation of VIX, which measures the volatility in U.S. benchmark stock index, with Brexit story count. They are showing quite an affinity.

This is another example that shows the nervousness in the market associated with Brexit. Nobody exactly knows, what might happen if Britons choose to be out of the European Union. It is an unprecedented event. Theoretically, nothing will happen immediately other than triggering of article 50; which states that the EU and the UK will have to negotiate terms of exit, which includes trade deal. Other than that nothing else. However, the market will be trying to price in the consequences such as another referendum in Scotland, end of FTA (Free Trade Agreements) with EU, end of capital account surplus, FDI from China and a lot more.

One thing can be said with certainty that there will be uncertainty on June 23rd and uncertainties if exit happens.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX