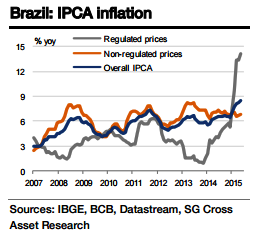

Brazil may inflation data and the IPCA-15 series release for mid-June suggests that inflation acceleration continued in Q2 despite the likelihood that adjustments to the prices of regulated goods and services are nearly over.

"The bulk of the upside surprise in May and June appears to be driven by a higher-than-expected rise in food prices, although inflation also continued to accelerate in the housing and transportation segments. Inflation is estimated to have risen above 9.0% yoy (0.90% mom) in June", says Societe Generale.

While housing inflation will likely tick above 18% yoy in June, food inflation likely entered into the double digits after a gap of 21 months. Higher food price inflation has been surprising given the decline in global agricultural prices but probably reflects the serious effects of drought in several regions.

Due to the surprisingly stronger acceleration in food prices over the past couple of months and the continued rise in prices of regulated goods and services, the upside risks to the nearterm inflation prospect have risen further above our revision to the inflation forecasts.

The insample forecasts from the structural inflation models put Q2 inflation at 7.0-7.2%, much lower than the observed inflation of 8.5% yoy.

The additional inflation may be attributed to the effect of price adjustments and the upside shock to food prices. However, while escalating upside risks imply that the medium-term inflation outlook remains considerably uncertain, the model estimates appear to confirm a continued surge in trend inflation fundamentally. Both these factors mean upside risk to the forecast that the Selic rate will peak at 14.50% in Q3 15, added Societe Generale.

Brazil's escalating upside risk to the near- and medium-term inflation outlook

Monday, July 6, 2015 5:39 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed