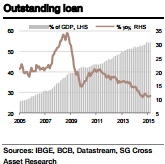

In recent months in Brazil, and as the effect of the liquidity measures introduced by the BCB and finance ministry in H2 14 ebbed, credit growth resumed its decelerating trend. Credit growth fell more than expected in April as business credit contracted in the month and its annual growth slipped to 9.0% yoy.

Clearly, growth weakness, rising interest rates and worsening investor sentiment are pulling credit growth down and there is little reason to expect a near-term turnaround from the recent trajectory.

"Overall, credit growth in May is expected to slip to a one-digit rate at 9.8% yoy first time in over a decade as business credit growth should fall to 8.5% yoy and consumer credit growth should fall to 11.3% yoy", says Societe Generale.

Although credit growth is slightly stronger in the consumer segment, that too has witnessed a continued slowdown and has been one of the key reasons behind the slowdown in consumption growth.

Brazil's credit growth deceleration likely continued in May

Friday, June 26, 2015 5:12 AM UTC

Editor's Picks

- Market Data

Most Popular