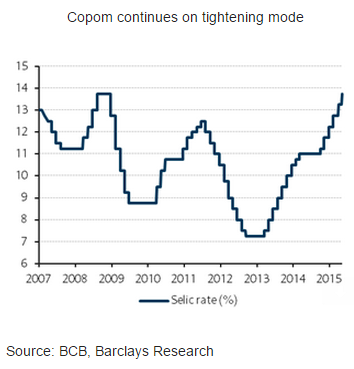

Today, the Copom decided to hike the Selic rate by 50bp, to 13.75%, in a unanimous decision, as consensus expected. The BCB did not change the post-decision communiqué relatively to the previous meeting, briefly saying that the decision was taken after evaluating the macroeconomic outlook and inflation perspectives.

It is believed that any change in the communiqué could be viewed as contradictory to the markedly hawkish speech by a couple of members of the Copom, which is aimed at anchoring inflation expectations and trying to regain credibility.

Any indication regarding the next steps of monetary policy should come only in the Inflation Report. In the next week's meeting minutes, the Copom is expected to bring a more deteriorated balance of risks for the growth outlook, in light of the data published between the April and June meetings.

However, any indication regarding the next steps of the monetary is likely to be reserved to the Quarterly Inflation Report due to be published by the end of the month.

If the Copom shows inflation forecasts closer to the mid-point of the target together with a downside revision of the growth forecast for this year (currently at -0.5%), it is believed that any indication suggesting the reduction of the tightening for July should be presented.

"We also expect a strong emphasis on the inflation expectations behavior, as a key variable for monetary policy. As of now, we expect the Copom to hike by another 25bp in July and stop the cycle with the Selic rate at 14.00%", says Barclays.

Brazil - Copom: Another hike followed by a laconic message

Thursday, June 4, 2015 2:00 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed