In September, US hiring created 142000 jobs, as per the official figures, less than expectations. Due to the near to zero average pay hikes, workers quit jobs, taking labor participation to 1970 levels.

The unemployment rate was consistent , but labor force had to see declines. There were no rises to the average hourly earnings as well. Last month, June and July's non-farm pay roll figures were revised up, which caused the unemployment to slip down to 5.1%. August figures were also lower than predicted.

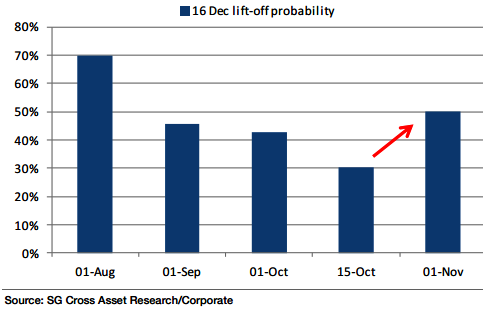

"In US, implied futures raised the probability of a first 25bp rate increase in December to 50% after a hawkish Fed FOMC statement on 28 October. The statement specifically referred to the next meeting where it will determine whether it is appropriate to raise rates, and removed the sentence referring to "recent global economic developments"", says Societe Generale.

US employment growth has slowed its pace from 234,000 over the previous two months. The October and November figures have to bounce back inorder to help the US Federal Reserve to hike its interest rates next month.

Bounce back necessary in US hiring to keep Fed's December hike on track

Wednesday, November 4, 2015 9:07 AM UTC

Editor's Picks

- Market Data

Most Popular

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal