The Bank of Japan kept policy unchanged at its meeting earlier on Thursday. The central bank held its key interest rate at minus 0.1 percent and kept the annual target for expanding the monetary base at 80 trillion yen ($764 billion). The decision likely reflects current global uncertainties, mainly the upcoming Brexit vote on June 23, the US Federal Reserve’s apparent hesitation to normalize monetary policy, and the approaching upper house elections in Japan on July 10th.

BoJ policymakers are under immense pressure to do more to bolster the economy amid sluggish global growth and anaemic inflation. But the upcoming Brexit vote on June 23rd may have erased the impact if the bank had moved now. Latest polls show rising odds that the UK will vote to leave the EU on Thursday next week. Financial markets will be shaken up significantly if a “Yes” vote on the Brexit is established. Crisis could prompt major central banks to intervene together in the FX market to curb excessive fluctuations.

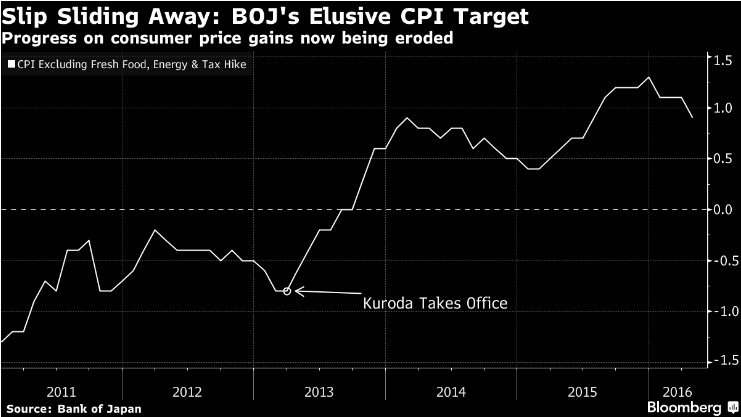

BoJ Governor Haruhiko Kuroda reiterated in a press conference in Tokyo that the central bank won’t hesitate to take action if needed. The governor expressed confidence that Japan's inflation will hit 2 percent target as forecast in 2018. He said Japan’s economy continues to expand gradually and cited solid plans for business investment. The following are the highlights of Kuroda's presser:

ON JAPAN'S ECONOMIC OUTLOOK - "Domestic demand is expected to recover as a trend, while exports will likely gradually increase as emerging economies emerge from their slowdowns. The underlying price trend is improving steadily. We expect Japan to achieve 2 percent inflation sometime during fiscal 2017."

ON PROSPECTS OF FURTHER EASING - "We will examine risks to the economy and prices, and won't hesitate taking additional easing steps if needed to achieve our 2 percent inflation target."

ON BREXIT - "BOJ is in close contact with the Bank of England and other overseas central banks. We will work closely with domestic and overseas authorities while closely monitoring the outcome's impact on the bond market and global financial markets including Japan's."

The monetary policy announcement prompted a large market response. The Japanese Yen surged across the board, rising around 250 pips against the US dollar and Euro and 400 pips against the pound. JGB yields hit record lows, benchmark 10-year JGB yield fell to all-time low of -0.194 pct, 30-year yield down nearly 5 bps to 0.168 pct, 15-year yield tumbled more than 1-1/2 bps to a record low of -0.040 pct and the 20-year JGB yield fell to a record low of 0.115 pct, down more than 3 basis points by 07:25 GMT.

"We expect the BoJ to revise down its forecasts next month. And when it does so, we expect to see further incremental monetary easing, with a further cut in the policy rate to -0.20%." said Daiwa Capital Markets in a report.

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook