The Bank of England’s (BoE) comprehensive stimulus package that includes a rate cut, £60 billion increase in securities package, introduction of £10 billion corporate bond purchases and an increase in the balance sheet by £100 billion via targeted loan program has triggered a record rush for the purchase of UK assets among investors, according to the data from EPFR Global.

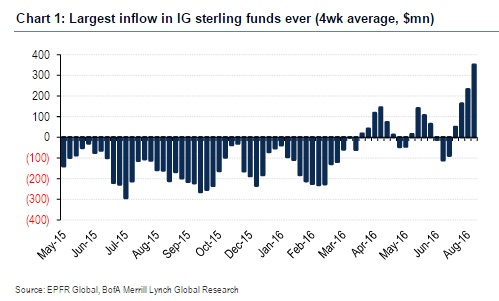

Last week, sterling investment grade corporate fund attracted $454 million inflows that brought the average inflows for past four weeks to investment grade sterling funds to close to $370 million. Average yields have plummeted to an all-time low of 2.05 percent, which is 140 basis points down from February this year. The yield spread between 10-year bund and 10-year gilt has narrowed by more than 60 basis points since April. Investment-grade bonds in the UK has returned more than 17 percent so far this year, while the counterparts in the Eurozone have returned 6.2 percent and 8.7 percent for those in the United States. Long dated gilts have been the best performer this year among all asset classes.

Bonds overall have been shining well this year, especially after the European Central Bank (ECB) introduced fresh stimulus measures in March. Since then, according to EPFR data, $30 billion has poured into global investment grade bonds, while $82 billion flew out of the equities.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX