The Bank of Canada (BoC) at its December policy meeting announced that it is maintaining its target for the overnight rate at 1/2 percent. The Bank Rate is correspondingly 3/4 percent and the deposit rate is 1/4 percent. BoC monetary policy is clearly diverging from that of the United States, where the Federal Reserve raised rates last week as the U.S. recovery gains strength.

Following a very weak first half of 2016, growth in Q3 rebounded strongly, but more moderate growth is anticipated in Q4. Even though domestic consumption is developing in a satisfactory manner the BoC seemed cautious as the effects of federal infrastructure spending are not yet evident in the GDP data.

In a year-end interview with the Globe and Mail newspaper last week, Governor Stephen Poloz expressed concerns about rising global protectionism. Poloz said that rise in protectionism began long before the U.S. election that brought Republican Donald Trump to power. He said that rising global protectionism could drive up the cost of goods and cause job loss, but dismissed the conclusion that Canadian exports will suffer under a Trump administration.

Meanwhile, business investment and non-energy goods exports continue to disappoint. There have been ongoing gains in employment, but a significant amount of economic slack remains in Canada, in contrast to the United States. While household imbalances continue to rise, these will be mitigated over time by announced changes to housing finance rules.

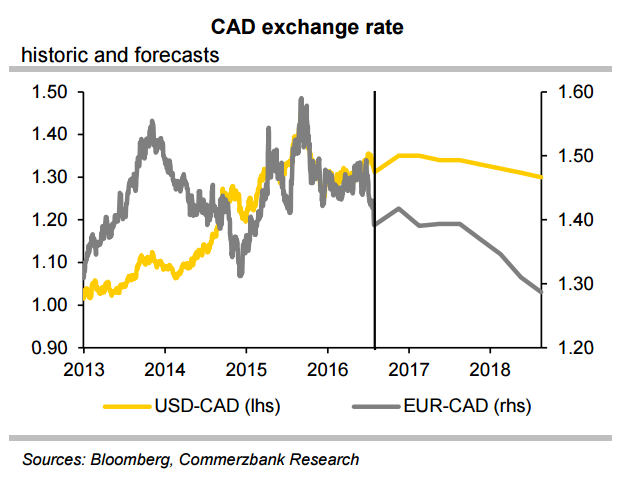

Inflation is not a major problem for the BoC. The central considers recent weakness in the inflation rate as temporary. At 1.5 percent inflation is currently still within the BoC’s target corridor. Post December Fed hike, USD-positive momentum is likely to continue for the time being keeping USD-CAD at high levels. Weak CAD is welcome by the BoC as it supports the competitiveness of domestic companies and fuels foreign demand.

"We do not expect it to cut key rates further though. Instead the BoC is likely to wait for some time yet before normalising its monetary policy. The prospect of a first rate hike is likely to emerge at the end of 2017," said Commerzbank in a report to clients.

USD/CAD is extending its upward trajectory from multi-week lows of 1.3131 hit on Dec 14th after holding strong 200-day MA support. The pair was trading largely muted on the day at the time of writing. Technical studies are biased higher. The pair has broken above 20-day MA and is on track for further gains.

FxWirePro's Hourly USD Spot Index was at 105.619 (Highly Bullish), while Hourly CAD Spot Index was at 5.92558 (Neutral) at 1150 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty