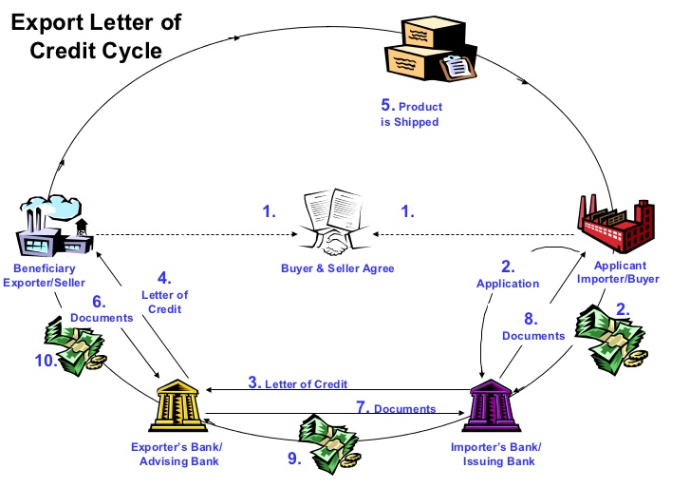

Let’s just glance through above diagram to know the basic understanding of export lifecycle before we head towards the core part of this write-up.

Right from the process of execution of sale deed through shipment, insurance etc upto the delivery of goods to the doorstep of the importer under Letter of credit payment mechanism seems to be more complex and highly manual system. As a result, a few shortcomings are spotted out in this mechanism and so is the similar challenges appear in other modes of trade finance, such as collections, open account, and advance payment systems. A few are listed below:

- Lack of securities and collaterals

- The absence of counterparty willing to offer financing alternatives outside the banking system

- Cost-centric

- Learner experience difficulty

- Complex presentation

Impact of blockchain on trade finance: Trade finance is an activity that has been around for a while, but has not seen much innovation in that time. In fact, it is still a largely paper-based business. This makes it more error-prone, time-consuming and fraud-sensitive than it could be.

Blockchain has the potential to change this. It provides an efficient and secure way of quickly settling trade transactions. This brings down costs, lowers operational complexity, reduces risk and lowers working capital needs. The cryptographic security underlying blockchain technology enables information immutability and credibility. The distributed ledger architecture provides transaction transparency, simplicity, and traceability (refer above diagram).

Although Blockchain can have a large impact on the way transactions and ownership are recorded, it is important to note that there are actually two types of blockchains: public and private blockchains. On a public blockchain, all parties engage with each other directly on a peer-to-peer basis and there is no intermediary. There are also no barriers to entry to a public blockchain. On the other hand, private blockchains do have barriers to entry and a ‘gatekeeper’ who governs the access to the blockchain.

Public blockchains are more resilient to cyber-attacks, but for many networks, the lack of privacy is a real issue. We hence expect that most of the near-future applications of Blockchain relevant to trading will be either private blockchains or a mix of both private and public blockchains. When discussing the implication of Blockchain below, we describe the effects of private blockchains on which all parties to a trade are present (e.g. traders, banks, shipping firms and warehouse operators).

Microsoft Corporation and Bank of America Merrill Lynch announced a partnership in 2016 on blockchain technology as the software giant continues to expand the scope of its ‘Blockchain as a Service’ (BaaS) platform for its Azure clients. In an announcement at the annual SWIFT-organized Sibos conference, the duos emphasized their objective to revitalize the trade finance gamut which is currently highly manual, time-consuming and costly processes.

Microsoft and BOA would build and test technology, create frameworks, and establish best practices for blockchain-powered exchanges between businesses and their customers and banks, according to a press release.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Standard Chartered’s Investment Arm, SBI Holdings to Set Up Digital Asset Joint Venture in the UAE

Standard Chartered’s Investment Arm, SBI Holdings to Set Up Digital Asset Joint Venture in the UAE  Citi Unveils Blockchain Platform 'Citi Token Services' for Enhanced Digital Asset Interaction

Citi Unveils Blockchain Platform 'Citi Token Services' for Enhanced Digital Asset Interaction  Mastercard's Shopping Muse: A New Era in AI-Driven E-commerce Personalization

Mastercard's Shopping Muse: A New Era in AI-Driven E-commerce Personalization  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays