2020 could well be the year that the cryptocurrency dream dies. This is not to say that cryptocurrencies will die altogether – far from it. But to all the financial romantics who have cheered the rise of bitcoin and other digital currencies over the past decade, there is a reckoning coming. Like it or not, the vision of a world in which these currencies liberate money from the clutches of central banks and other corporate giants is fading rapidly.

It is not that these currencies have no place in the future of money. The encrypted blockchain technology that underpins them is extremely difficult for governments to control, so it is unlikely that they will ever be eliminated. In any case, they have a valid role to play as a geopolitical hedge – witness the surge in bitcoin and cryptocurrencies after the latest escalation in tensions between the US and Iran, for instance.

But 11 years on from bitcoin’s remarkable beginnings, cryptocurrencies are a long way from supplanting the financial system. At the time of writing, the total value of all the bitcoin in circulation is US$133 billion (£102 billion); in comparison, the market value of all the world’s gold is around US$8 trillion, while the total worth of mainstream currencies worldwide is roughly the same again.

No new hope

The so-called bitcoin maximalists foresee a day when their currency of choice rises into the top league. They point to the bitcoin “halvening” expected in May – the moment every four years when the number of new coins being added to the network is halved – as the next event that will drive prices up.

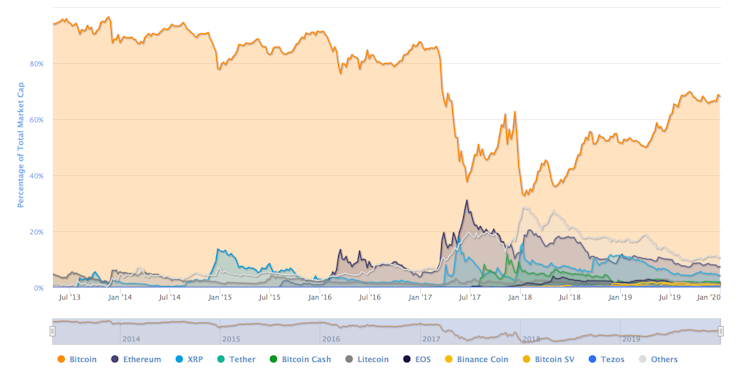

Yet the long-term prospect for bitcoin and other cryptocurrencies is stasis on the peripheries of the financial system. The chances of a new bitcoin look increasingly slim: it’s several years since ethereum rose to become the prime challenger, before falling back to a fraction of the bitcoin price (click on the chart below to make it bigger).

Bitcoin vs altcoins

Share of total market cap of crypto by coin. Coin Market Cap

More importantly, a much bigger threat to the current system is afoot – as evidenced by Facebook’s attempts to get its libra digital currency off the ground. JP Morgan has already launched a JPM coin for major institutional clients, while numerous other major banks are set to follow suit. Other tech giants like Amazon, Google and Apple are rumoured to be looking at launching rival currencies as well.

Their model is what are known as stablecoins – a sort of crypto hybrid that lives on blockchains but is pegged to mainstream currencies. But aside from this connection to the status quo, these multinationals would be challenging sovereign money. They want to opt out of the clunky system that they have been forced to operate in, with its transaction fees and international payment delays, to present customers with an alluring alternative instead.

The reason these companies are not throwing their weight behind bitcoin et al is because today’s cryptocurrencies have at least as many drawbacks as the mainstream system. Their prices are too volatile to act as a serious store of value, for instance, while their ability to process financial transactions is not yet particularly impressive.

It has dawned on the corporate giants that as per their products or services, they can make money part of their brand – part of the customer experience. Sell people goods and services, yes, but also offer them a new monetary system to take care of the purchases. It begins to look like almost total control.

The empire strikes back

The state has been late to wake up to this challenge, but has now done so in a powerful and surprising way. The traditional global infrastructure has proved strong enough to derail the corporates at least temporarily with red tape. Yet make no mistake – the goalposts have completely changed, and it will be difficult to present a united regulatory front around the world. Ironically, it is the same lack of global uniform regulatory approval for the existing cryptocurrencies that has hindered their meaningful adoption.

The other response under examination is to launch state cryptocurrencies. The likes of China and Russia are in pole position to launch the first within a couple of years. Deutsche Bank recently published a report suggesting that cryptocurrencies could overtake national fiat currencies within ten years, envisaging that these state-backed versions will lead the charge.

Yuan 2.0. KachuraOleg

In short, the future of cryptocurrency lies in either corporate or sovereign digital coins – or more likely, an uneasy cohabitation of the two. The system supposedly under threat from bitcoin and the other so-called bank killers is instead assimilating them. The coins that emerge maybe won’t even use blockchains, acting more akin to Paypal or WeChat Pay than as cryptocurrencies as we know them.

Where the previous half century saw the rise of corporates to a size and influence comparable to nation states, the next half century could produce a new paradigm in which they increasingly behave like nation states. When we reflect on the way these companies already manage our data, the way they exert lobbying influence on our governments, the trend is clearly well underway. Call it the next phase of globalisation.

Money in 2030 will probably therefore be almost unrecognisable compared to what we use today. The dream of universal people-powered monetary substitutes is being crushed by this unanticipated but in hindsight inevitable institutionalisation. It is from within the multinational world that the “next bitcoin” will emerge – wrapped in the liveries of a corporate brand, if not a sovereign flag. As for the great dream of bitcoin liberation, may it rest in peace.

Gavin Brown is a non-executive director and co-founder of Winterbar Associates Limited, a start-up digital assets fund which has yet to launch. It would not benefit directly from this article but does have an interest in digital asset investments such as bitcoin which leverage blockchain technology.

Whilst Richard Whittle has received no direct funding for this article, the background research was conducted as part of his ESRC-funded PhD.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary