The surprise "one-off depreciation" of the yuan by the People's Bank of China led to price divergence between USD and CNY exchanges as holders of yuan resorted to bitcoin as a safe haven.

BTC/USD soared to 271.50 levels on Tuesday, but lost momentum and is trading in the red today at 268.25 levels. However, short- term trend is bullish as long as support $247 holds.

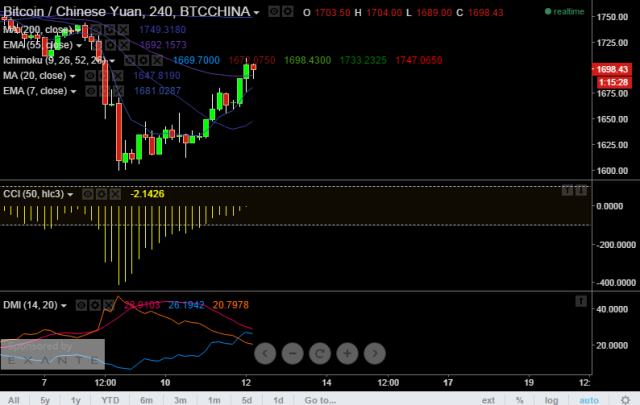

BTC/CNY rose from 1633.68 (Monday's close) to 1690.36 (Tuesday's close) following the devaluation. Today it hit an intraday high of 1710 before sliding to 1699.39 levels, where it is currently trading.

In order to guard against losses, yuan-holders can purchase bitcoin and later cash back into yuan if bitcoin price goes up or to US dollar if bitcoin price declines.

Bitcoin attracts yuan holders post PBOC devaluation

Wednesday, August 12, 2015 6:47 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary