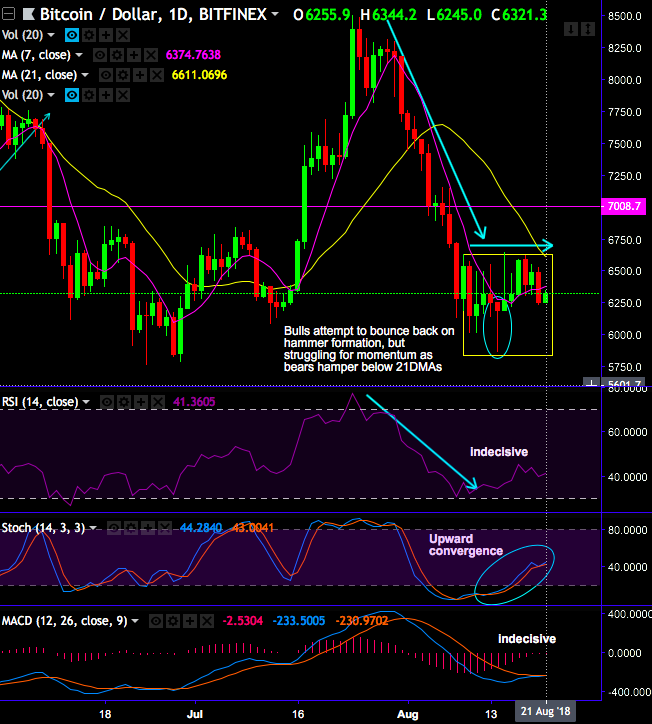

Although the bulls of BTCUSD have attempted to bounce back last week from the lows of $5,858.6 levels bears have resumed yesterday at $6,524 levels (i.e. near 21-DMAs), the bullish momentum is not convincing. As a result, the trend goes in sideways for the day.

On a broader perspective, it has tested the strong support at 78.6% fibonacci levels from the peaks of last december’2017 (i.e. 5701 levels).

Well, it is now stuck in the range between $6,524 and $5,755 levels over the past few months, we’ve got mixed bag of analysts who have been differed on the influence of the presiding of the US SEC (Securities and Exchange Commission) of Bitcoin ETFs applications.

For now, ProShares, a premier provider of ETFs, launched the first ETFs underpinned by bitcoin futures contracts back in last December investing only in retailers principally selling online or through other non-store channels. The ProShares Online Retail ETF (NYSE Arca: ONLN) focuses on the largest players in the space—iconic companies like Amazon and Alibaba, whose rise is reshaping the retail world.

The U.S. securities regulator are scheduled to decide whether they could approve the ProShares Bitcoin ETFs and the ProShares Short Bitcoin ETF by this Thursday.

Unlike the deferral of an approval of CBOE's VanEck/SolidX bitcoin ETF proposal, the rule change proposal filed by ProShares in conjunction with NYSE Arca would not be delayed any further under the regulator's rules.

Having said that, one should not forget the vigorous bullish trend last year, the journey from $735.3 to a whopping $19,891. (at BITFINEX exchange), or 2,605% surge was commendable. However, on the contrary, the Bitcoin bears have held steady from the last couple of months’ trading sessions but oscillating between the range of 5700 levels to 11700 levels.

Currency Strength Index: FxWirePro's hourly BTC spot index has shown -149 (bearish), while USD spot index flashes -146 (which is bearish), while articulating at 05:53 GMT. For more details on the index, please refer below weblink:

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary