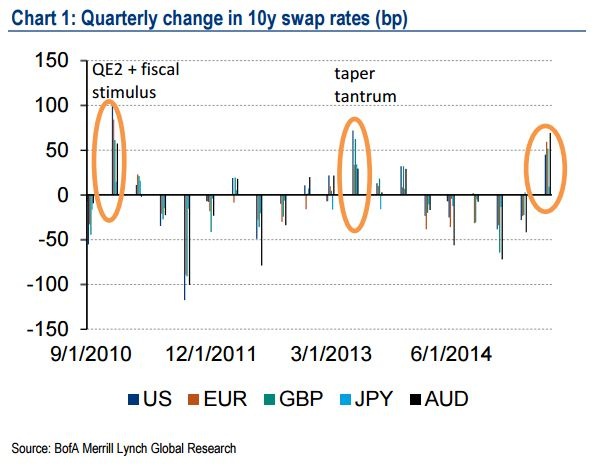

Rightly or wrongly, fixed income investors have been heading for the hills lately. As a result, global rates, especially the long-end of the yield curves, have backed up sharply. Indeed, the rates sell-off has been so violent that the increase in 10y rates of major markets in Q2 was the largest since taper tantrum.

Eurozone and Australia led the sell-off but the bond rout has been pretty broadbased. Indeed, both Eurozone and US 5y rates 5 years forward are now back to levels unseen since last September, two months before the November OPEC meeting and four months before the ECB announced QE. The sell-off in rates has also spilled into the corporate bond market, with IG spreads rapidly approaching the levels reached during taper tantrum.

An important aspect of the recent bond sell-off is that real yields have gone up more than inflation breakevens. One interpretation is that investors are becoming more optimistic about the general growth outlook and that they are reassessing how much more monetary easing is necessary to support global growth. The fact that Treasury yields have been seemingly impervious to the renewed decline in oil prices would also suggest that investors are no longer fixated on deflationary risks like they were earlier in the year.

"In our latest FX and Rates Sentiment Survey (conducted just after the Greek referendum and before the Chinese stock market stopped falling), 85% of the respondents expect at least one Fed hike this year and few expect rates to rally on a dovish ECB," says BoFML Research.

Biggest bond selloff since taper tantrum

Tuesday, July 14, 2015 12:34 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX