Today European inflation as measured by CPI would be released at 9:00 GMT.

- Preliminary reading showed that inflation as measured by CPI is expected to grow 0.2% m/m and to grow 0.3% on yearly basis. Core consumer price is expected to grow at 0.9%.

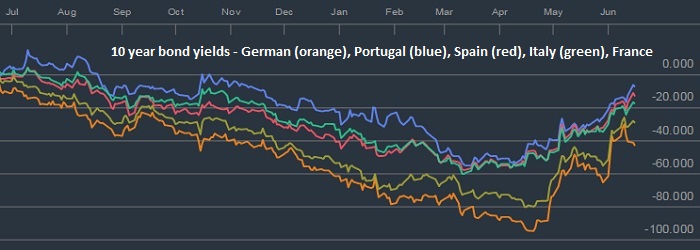

European Central Bank's (ECB) purchase program seem to be sparking inflation across Euro zone, faster than originally anticipated, which sparked rout in European bond market leading it to erase all of this year's gain and beyond.

- Portugal's 10 year bond is currently yielding 3.21%, a level not seen since October last year.

- German 10 year recently touch above 1% yield, however sharply dropped from there currently trading at 0.8%

- French 10 year yielding at 1.25%, which brings France-German Spread to 15 month high.

- Italian 10 year is at 2.33%, a level of yield not seen since November last year.

- Spanish 10 year yield is at highest level since August last year at 2.36%.

Euro zone yield could burst into another set of rallies, if inflation keep surprising to upside. Shorter term yields, however are expected to remain depressed and broadly anchored to the deposit rates of ECB, which stands at -0.2%.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?