Today second estimate of US first quarter GDP will be released at 12:30 GMT.

After FOMC refrained from hiking rates in April but minutes gave a strong hint that they may move ahead in June if data supports, participants are likely to turn their attention to today’s GDP number, which is second flash estimate.

Past trends –

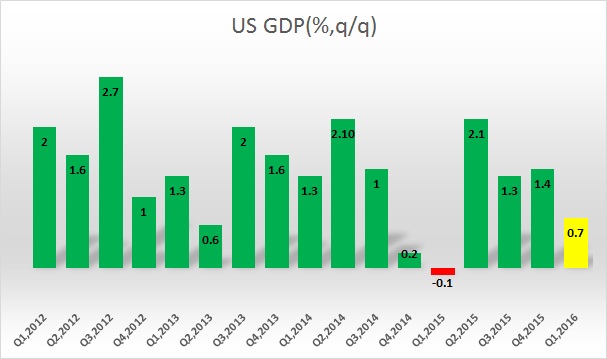

- US GDP picked up pace since 2013 and increased pace in 2014. However after rising 5% and 2.2% in previous two quarters, US GDP shrank by -0.1% in the first quarter of 2015. Historically speaking US economy usually falters in first quarter.

- Second quarter was relatively better, with GDP growing at 2.1% in second quarter from the first.

- Growth has slowed further in third quarter, with GDP growing about 1.3%.

- Final quarter GDP was much better than expected at 1.4%, still meager compared to 2014.

- First flash estimate showed GDP grew by 0.7% in first quarter this year.

Expectation today –

- It is expected to come in line with first flash estimate.

- However 0.7% growth isn’t bad, considering first quarter usually to be the worst in the year.

Market impact –

- US economy is largely expected to weaken, but if the number drops in negative, it might steal away recent equity rally and Dollar might drop hard. However weaker but positive number above 0.5% may not make much of a difference.

- However, if data do surprise on the positive side then it has higher potential to be a market mover. Any number above 1% would push U.S. equities higher and make Dollar stronger.

In latter case Dollar is likely to rise against Euro and emerging market currencies while Pound remains occupied with Brexit.

Dollar index is currently trading at 95.25, up 0.11% today.

Saying all that, GDP may not make much of a difference as market is focused on Yellen's speech later in the day, around 17:00 GMT.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022