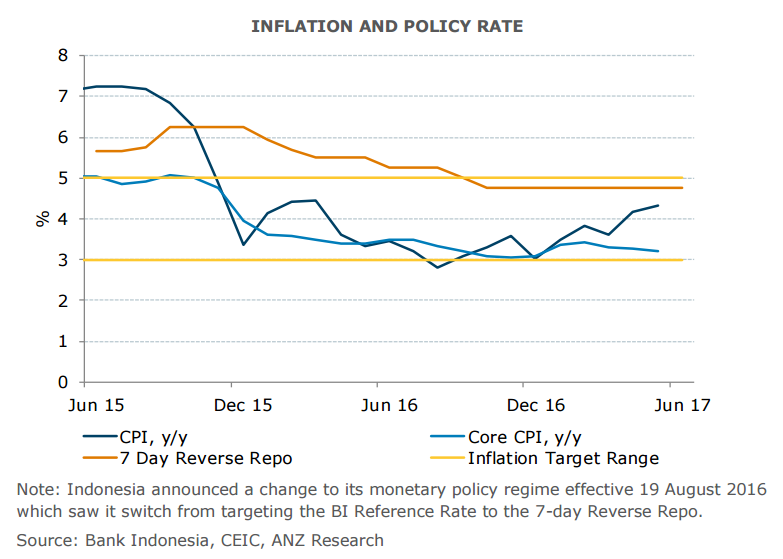

Indonesia's central bank, Bank Indonesia (BI), kept its policy rate on hold at 4.75 percent, as widely expected at its June meeting. Bank Indonesia has kept its benchmark interest rate unchanged at 4.75 percent for seven months, after six rate cuts last year. The 7-day reverse repo rate has remained unchanged since October 2016. The deposit facility and lending facility were held at 4.00 percent and 5.50 percent, respectively.

Bank Indonesia held rates amidst an environment of stable growth and curtailed inflation and said that it does still see several external and domestic risks. The central bank said that the current level still fits efforts to maintain stability and support growth. While South-east Asia's biggest economy is gradually recovering, it faces risks from a slowdown in China and weaker prices of coal and palm oil, the nation's main commodity exports.

Bank Indonesia Governor Agus Martowardojo said Indonesia's recovery in growth is likely to continue into Q2, but said he foresees a correction mainly in Q3. The central bank has revised down its target for the country's economic growth this year from 5.2 percent to 5.17 percent year-on-year.

Inflation accelerated to the highest in more than a year in April at 4.17 percent, above the mid-point of the bank's 3 to 5 percent target band. Headline inflation is likely to rise largely reflecting higher electricity and fuel prices. However, core inflation has remained benign, suggesting that demand conditions are still not strong enough to lead to a meaningful pass-through of administered prices.

"With growth likely to be in the 5-5.4% range, demand pull inflationary pressures should remain in check. The moderate growth acceleration and limited demand-pull inflation pressures suggest that the central bank will remain on hold through 2017," said ANZ in a report.

USD/IDR was trading at 13308 at 1200 GMT. The pair has been trading in a narrow range since the beginning of the year. A break above 13400 could see further upside. Technical indicators are neutral and do not provide any clear directional bias. FxWirePro's Hourly USD Spot Index was at 127.377 (Bullish) at 1200 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment