The dollar remained mostly advancing against the major baskets of currencies after an above forecast US jobs report bolstered expectations for a rate hike from the Federal Reserve later this year.

The US has added 280k jobs in May which is way beyond economists forecast at 220k.

The upbeat data emphasizes the outlook of the economy is on track to rebound after a weak performance in Q1 and bolstered expectations that the Fed could start to hike interest rates at its September policy meeting.

Derivatives advisory:

Option strategy: Bear Put Spread (USD/CAD)

Since we had anticipated a downtrend on this pair soon after it breached trend support at 1.2464 levels, now it continues to slide further to find stronger support which is seen at around 1.2379 and next at 1.2298 levels.

In order to safeguard US traders with CAD exposures, recommendation is on a partial hedge strategy which minimizes the loss if the underlying currency has to move lower but does not cap the loss.

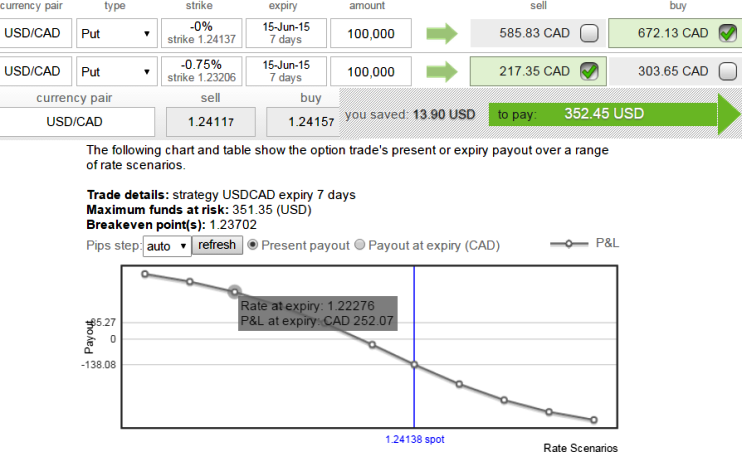

Bear Put Spread = Long on ATM Put (strike at 1.2413) + Short another Put with lower Strike Price (Out of the Money at 1.2320).

This execution reduces the cost of hedge by the premium collected (as shown in the figure CAD 217.35) on Out of the money Put but it comes at the expense of Partial hedge rather than a complete hedge.

BPS safeguards US traders’ cost of hedging

Monday, June 8, 2015 12:58 PM UTC

Editor's Picks

- Market Data

Most Popular