At today’s meeting, policymakers at the Bank of Japan (BoJ) kept the policy unchanged, and the benchmark interest rate at -0.1 percent.

Let’s look at the current monetary policies,

- Bank of Japan had already shifted the timeline for reaching the 2 percent inflation goal to “earliest possible time” and with that view, it had introduced QQE with yield curve control. It means that the bank would guide both short term and long term rates while purchasing assets at the pace of ¥80 trillion per annum until the inflation overshoots the 2 percent target and stays above.

- For short term rate controls, BoJ will maintain a negative interest rate of -0.1 percent and for the long term rate control, it would purchase assets in such a manner that the 10-year yield remains around zero percent.

- In addition to that, BoJ would use fixed rate purchases of JGBs and fixed rate funds supplying for a period up to 10 years.

- The bank will continue to purchase ETFs at ¥6 trillion per annum, CPs at ¥2.2 trillion annually, corporate bonds at ¥3.2 trillion annually, and J-REITs at ¥90 billion per annum.

Key takeaways from the economic outlook -

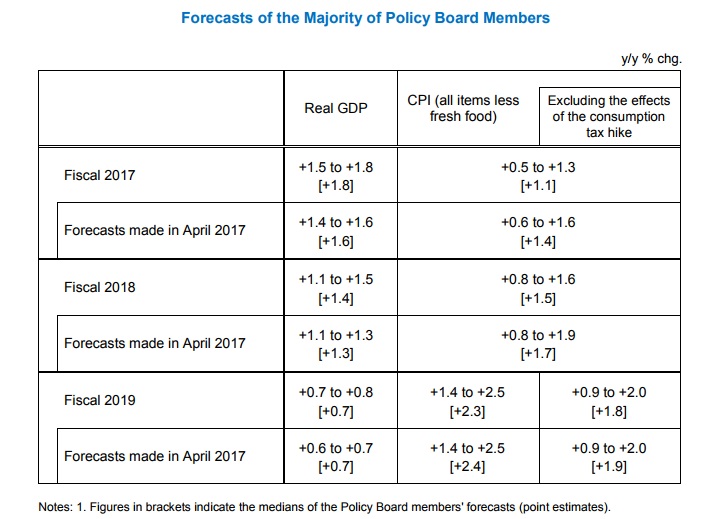

- Japan’s economy likely to continue expanding on the back of an accommodative monetary policy and government’s large scale fiscal stimulus. With the growth in overseas economies improving moderately Japan will be able to maintain a growth above pace through the fiscal year 2018. However, growth would slow down in 2019 due to cyclical slowdown in business fixed investments and effects of scheduled consumption tax hike. (Mild dovish bias)

- Inflation is likely to continue its uptrend and increase towards 2 percent on the back of improvement in the output gap and a rise in medium to long-term expectations .However, it remains weak as of now. (Neutral bias)

- To summarize, growth is projected higher while CPI is projected weaker. (Neutral bias)

- Risks to both economic activity and prices are skewed to the downside. (Dovish bias)

- BoJ says that it would continue with its monetary policy unless inflation reaches 2 percent objective. The bank would do adjustments as necessary. (Neutral bias)

The Bank of Japan’s (BoJ) monetary policy statement remains broadly balanced but tilted towards dovish as of now. The yen is currently trading at 112.2 per dollar, down 0.3 percent for the day so far.

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence