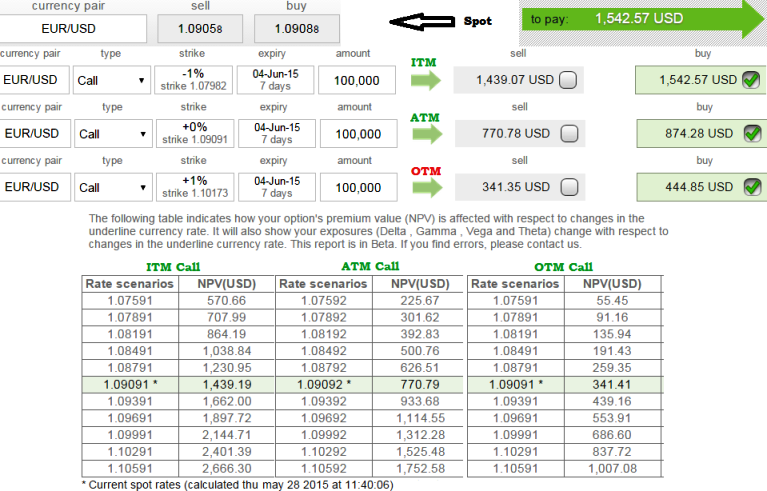

- For the simplest rationale, use either ITM or ATM Calls of this pair as Net Present Value suggests OTM calls are trading almost 25-30% costlier.

- As shown in the figure NPV of ITM call is 1439.19 while it is trading at 1542.57 premiums 7.19% higher which is quite reasonable.

- NPV of ATM call - 770.79 while prevailing price is at 874.28 premiums 13.42% higher which is still reasonably acceptable.

- NPV of OTM call - 341.41 while option is trading at 444.85 premiums 30.29% higher which is crazily noising.

- In order to achieve the hedging objective investor should be aware of money management skills and here the objective is to arrest the downside risks of dollar, nothing else.

Hence, we advocate either ITM or ATM calls irrespective of Black Scholes indications.

Avoid OTM calls of EUR/USD irrespective of Black Scholes

Thursday, May 28, 2015 6:39 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate