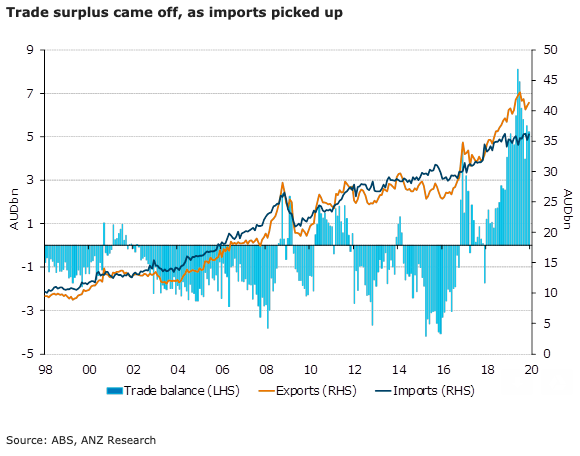

Australia’s trade surplus fell slightly to AUD5.2 billion in December, below market expectations. The decline was driven by a larger rise in imports compared to exports. Imports rose 2.4 percent m/m, while exports were up 1.4 percent m/m.

Stronger resource exports were the primary drivers of the pick-up in exports, while service exports fell. Imports were up across the board, with sharp rises in capital and consumption goods imports.

Total resource exports rose 2.9 percent m/m in December and are now 12.1 percent higher than a year ago. The increase largely reflects higher iron ore exports, which rose 3.3 percent m/m, as well as LNG, up 2.6 percent m/m.

Non-monetary gold continued its recent volatility rising 14 percent m/m after declining 6 percent in the previous month. The RBA’s commodity price index was down 1.1 percent in December, which suggests that the rise in resource exports was likely due to a rise in volume.

Manufacturing exports continued to decline, by 3.3 percent m/m. Service exports had the first material decline in some time, falling 1.1 percent m/m.

Capital goods were up 6 percent m/m, leading the increase in imports. A large part of this was due to increased transport equipment imports, which rose 23 percent m/m. Consumption goods had a strong month, largely reversing the decline from November. Fuel imports, for example, were up 4.7 percent m/m.

"Given the preliminary December quarter trade balance, net exports are unlikely to contribute much to GDP growth," ANZ Research commented in its latest report.

Oil Prices Surge Toward Biggest Monthly Gains in Years Amid Middle East Tensions

Oil Prices Surge Toward Biggest Monthly Gains in Years Amid Middle East Tensions  Wall Street Slips as Tech Stocks Slide on AI Spending Fears and Earnings Concerns

Wall Street Slips as Tech Stocks Slide on AI Spending Fears and Earnings Concerns  China Factory Activity Slips in January as Weak Demand Weighs on Growth Outlook

China Factory Activity Slips in January as Weak Demand Weighs on Growth Outlook  Asian Currencies Trade Flat as Dollar Retreats After Fed Decision

Asian Currencies Trade Flat as Dollar Retreats After Fed Decision  UK Housing Market Gains Momentum in Early 2026 as Mortgage Rates Fall

UK Housing Market Gains Momentum in Early 2026 as Mortgage Rates Fall  Trump to Announce New Federal Reserve Chair Pick as Powell Replacement Looms

Trump to Announce New Federal Reserve Chair Pick as Powell Replacement Looms  UK Vehicle Production Falls Sharply in 2025 Amid Cyberattack, Tariffs, and Industry Restructuring

UK Vehicle Production Falls Sharply in 2025 Amid Cyberattack, Tariffs, and Industry Restructuring