Australia's January labour market report released earlier today was broadly in line with expectations. Data released by the national statistics bureau showed seasonally adjusted overall employment rose by 13,500 to 11,998,200 in January, following a revised gain of 16,300 the previous month, widely beating expectations for an increase of 9,700. The unemployment rate ticked down to 5.7 percent as workforce participation edged down to 64.6 percent from 64.7 percent. Despite the drop in full-time employment total hours worked rose by 10.2 million hours to 1.6827 billion hours.

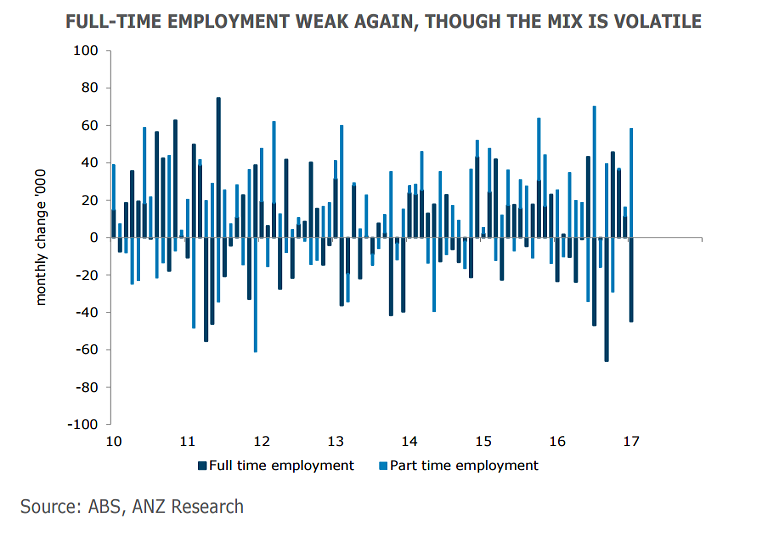

However, gains in employment were driven by part-time jobs while sharp decline was seen in full-time employment in January. Part-time jobs surged by 58,300 during the month, offsetting a sharp decline in full-time workers, which tumbled by 44,800. Over the past year, part-time employment grew by 159,400 or 4.3 percent. At the other end of the spectrum, full-time employment fell by 56,000, or 0.7 percent.

The labour market report justifies the Reserve Bank of Australia (RBA) in its cautious, neutral approach. The RBA is unlikely to be totally satisfied with the January labour market report. Also, a strong exchange rate might complicate the process of structural change in the economy away from the commodity sector. While the strong lift in ANZ business conditions this week points to better times ahead, there is still spare capacity in the labour market.

The unemployment rate has now been in a range of 5.6-5.8 percent since February 2016, implying little success in reducing spare capacity. This suggests it is too early to expect a pick-up in next week’s Wage Price Index. ANZ said in a report "We are still some way off from expecting a lift in domestic inflation pressures that will necessitate a shift away from a neutral stance."

The Reserve Bank of Australia’s (RBA) Monetary Policy Statement (SoMP) released last week showed that the central bank expects inflation to accelerate to 2 pct – 3 pct by mid-2019. The RBA projects the jobless rate at 5 percent to 6 percent over the forecast horizon. The central bank revised down near-term economic growth considerably.

"The January employment data has no impact on our view that the RBA is on hold for an extended period," said ANZ in a report.

Aussie was dampened after mixed jobs report. AUD/USD was trading largely unchanged on the day at 0.77 at around 1215 GMT. FxWirePro's Hourly AUD Spot Index was highly bullish at 150.621. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist