The Reserve Bank of Australia remains optimistic about prospects for the economy. The central bank said last week that both record-low interest rates and a weaker Australian dollar were helping to support modest growth. Monetary conditions in Australia are set to remain accommodative over the coming quarters. The RBA lowered benchmark interest rate by 25 basis points to the current record low level of 2.00% in May and has kept the key rate stable at subsequent meets, the most recent one on Sept 1st.

Australia's economic performance remains relatively soft, partially reflecting low iron ore prices and weaker import demand from China. Despite registering below-trend output growth, activity will be underpinned by a higher volume of resource exports - offsetting material price declines - on the back of increased mining capacity following several project completions.

Treasurer Joe Hockey has also dismissed fears about China's economic slowdown affecting Australian economy and said the country's economy is resilient enough to cope with any turbulence from the Chinese economy. Comments come at a time when Australia's economy posted a tardy growth of 0.2 percent q/q in Q2 following a solid 0.9% q/q advance in the first three months of the year.

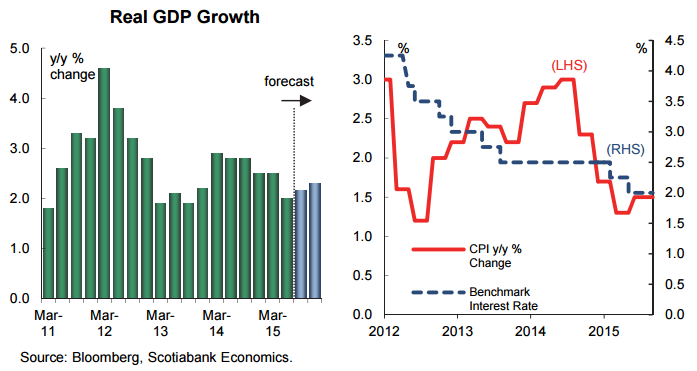

"We expect Australia's economy to expand by around 2.03% this year, followed by a pick-up to 2.75 in 2016", estimates Scotiabank in a report.

Some recent indicators are consistent with a moderate expansion in the Australian economy. The NAB business survey reports that in August business conditions strengthened as confidence slipped. Total employment rose a sound 17.4k in August, well above market expectations for a 5k rise. Inflation rose slightly in the second quarter of 2015 to 1.5% y/y, yet it still remains below the RBA's 2-3% target.

"We estimate that price gains will stay below the target through the end of the year, closing 2015 at 1.5% y/y before accelerating moderately in 2016 to 2.0% by year-end as AUD depreciation feeds through to higher import prices", says Scoitabank.

The AUD's steady decline has provided some fresh lows below 0.7000, to levels last seen in early 2009. The Aussie is likely to remain weak over the near-to-medium term, with risk biased to further downside. The divergence in outlook between the US Fed and RBA along with added risk of continued weakness in commodity prices given concerns surrounding the path of growth for China likely to add further pressure.

"We hold a year-end 2015 AUD forecast of 0.7000, and the primary risk to our forecast is centered on developments in China. We look to stabilization and modest strength into year-end 2016 with an AUD forecast of 0.74", adds Scotiabank.

The Australian dollar popped higher on Monday, having proved resilient to another set of disappointing China data over the weekend. AUD/USD was trading at 0.7127 at 1100GMT, slightly lower from day's high at 0.7135.

Australia's growth to expand this year, monetary conditions to remain accommodative

Monday, September 14, 2015 11:40 AM UTC

Editor's Picks

- Market Data

Most Popular

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady