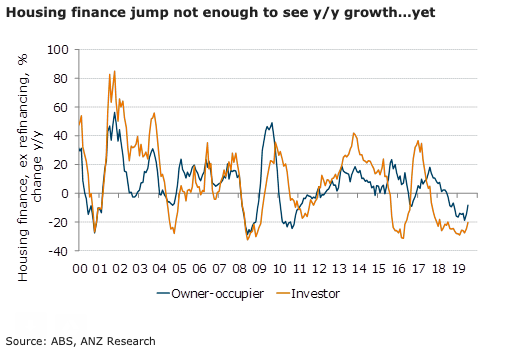

Australia’s demand for mortgages picked up sharply in response to rate cuts in June and July, with 5.1 percent m/m growth in July. The strength was reflected across both owner-occupiers and investors. The Reserve Bank of Australia (RBA) is unlikely to be impressed by these numbers, according to the latest report from ANZ Research.

Investor lending was up 4.7 percent m/m in July, ex-refinancing, the strongest monthly result since September 2016. This is a strong sign of investor optimism after sharp declines in investor demand during the housing price adjustment. Annual growth in investor lending is still sharply negative (-20.4 percent y/y to July), however this is the smallest negative result since July 2018.

Owner-occupier lending grew 5.3 percent m/m in July ex refinancing, the highest result since August 2015. Annual growth is still negative (-8.3 percent y/y), but it is the smallest negative result since October 2018.

Interestingly, approvals for the purchase of new homes jumped 20.8 percent, the strongest rise since 2001. This suggests that the pick-up in housing prices and finance will soon feed through into construction activity.

Regulatory easing in July (APRA relaxed the 7 percent+ floors on mortgage serviceability) heightened the effects of rate cuts, by allowing lower rates to more directly affect serviceability assessments.

Optimism in the housing market following green shoots in prices in Sydney and Melbourne prices may have also spurred on extra demand. Ongoing elevated auction clearance rates suggest that the strength has continued into September.

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances