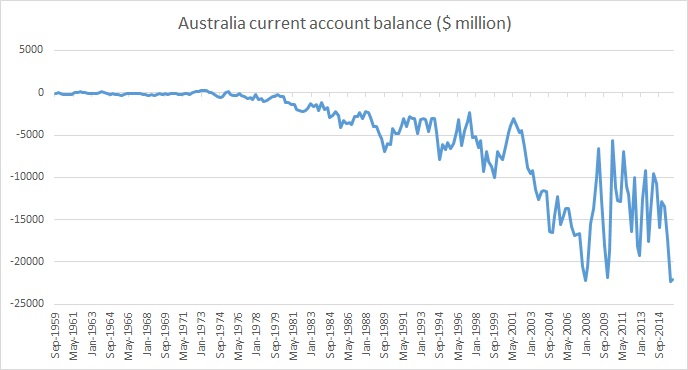

Today's data released from Australia shows, current account deficit for the fourth quarter hasn't improved much and hovering at record high level, comparing data that goes back to as early as 1959. Twin attack from lower commodity prices and weaker demand from China has taken its toll on Australia, which is trying to recover from Dutch disease.

Recent deficit has reached levels seen during the period of great recession. Back in 2007, Australia recorded deficit of -$76.16 billion. But even during 2008/09 crisis, Australia's current account deficit didn't reach that level, it improved from 2007 to about -$60 billion for each of 2008 and 2009. In 2010 deficit dropped further due to higher prices compared to recessionary level and demand from China to -$48 billion and to -$42 billion for 2011.

Only from there it has started deteriorating again due to the twin factor and reached -$75 billion in 2015.

Latest data however points that due to weaker exchange rate, Australian economy is weathering the storm well. Today in its monetary policy Reserve Bank of Australia (RBA) has conformed over this. It has maintained its 2% interest rate, saying that economy has chance to recover going ahead, despite weakness in mining sector.

Australian Dollar is currently trading at 0.715 against USD.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX