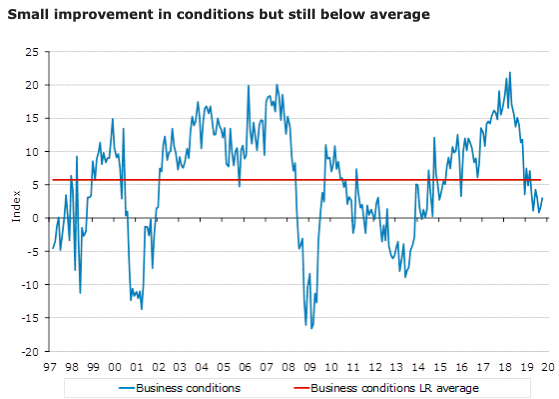

Australia’s business conditions and confidence recovered a little ground in October. While there is still a long way to go before a recovery can be considered in the private sector, there were some tentatively positive signs, ANZ Research reported.

Business conditions recorded another small improvement in October, hitting a three-month high of +3.0, but it is too early to tell if this will be sustained. Confidence also rose slightly to +1.7. Forward orders (up 5.1pts), profitability (up 1.6pts) and trading (up 2.4pts) all rose.

Capacity utilisation recorded a slight decline to 81.7 percent, while the employment index and labour cost growth were largely flat.

Profitability and trading saw a second month of moderate improvements. On the other hand, capacity utilisation and employment were largely flat. Overall, the business sector has not been much responsive to monetary and fiscal stimulus, the report added.

Most states recorded improved business conditions during the month; Queensland was the only state to deteriorate. Most states are running well below their long-run averages, with Queensland, Victoria, and Tasmania in the weakest positions (smoothed using three-month averages). New South Wales has improved over the past few months to just below its long-run average.

Mining, construction, finance, and recreation services all contributed to the monthly gain in business conditions. Manufacturing and transport were the largest detractors. Retail business conditions have been stable for the past few months but remain deep in negative territory.

Mining business conditions are marginally above their long-run averages but all other industries are in negative territory (smoothed using three-month averages).

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals