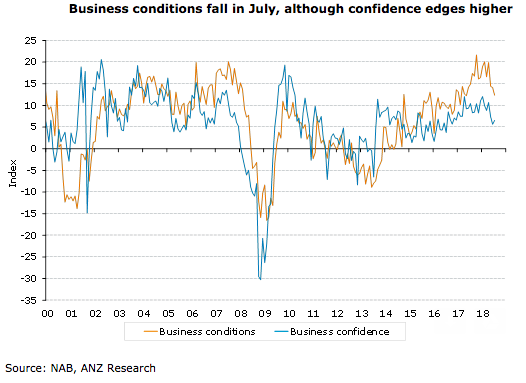

Australia’s business conditions edged lower during the month of July, but the survey continued to suggest that employment growth should remain solid in the near term. The business sector has been a key driver of growth over recent years, through the lift in non-mining investment, and the drop in conditions while not yet worrying deserves close watching, according to the latest report from ANZ Research.

Business conditions index fell to 12.4 in July from 14.1 in June and now well down from the peak levels reported from October last year through to April. While conditions remain above the long term average for now, we will be watching business conditions closely over coming months, given that non-mining business investment has been such an important pillar of the recovery to date.

However, the details of the survey remain relatively solid, although like the headline index, well down from recent highs. The profitability and trading indexes fell in July, although the employment index rose solidly. Capacity utilisation edged lower, but remains well above its long run average. Together these indicators continue to point to solid (but not spectacular) employment growth and a further gradual decline in the unemployment rate, the report added.

Across the states and industries business conditions continue to vary significantly. Tasmania is now reporting the strongest conditions relative to the long run average, while Western Australia (WA) is reporting the weakest. That said, WA is well off its 2016 lows. In terms of sectors, mining remains the strongest sector, alongside manufacturing and construction, while the retail sector remains in the doldrums despite the recent good news on sales.

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out