Westpac Research notes:

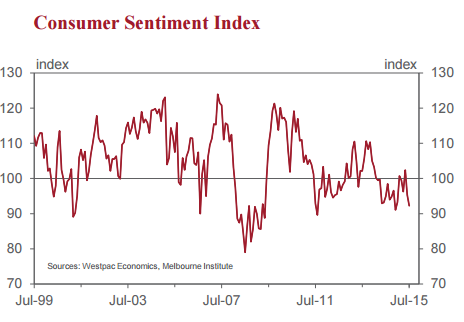

This is the lowest print of the Index since December last year. The Index is now firmly in the range where pessimists outnumber optimists. In fact the Index has printed below 100 in 15 of the last 17 months.

Having made that overall assessment it is not surprising that we saw a solid fall in the Index in July. We had a taste for households' sensitivity to disturbing news around European instability in December 2011 when the Index tumbled by 8.4% from 103.4 to 94.7. This time the concerns around Greece have been complemented by sensational coverage of the collapse in the Chinese share market.

Back in 2011 the Index recovered by 6.7% once European fears settled down and it is likely that the impact on confidence of the European developments will once again prove to be transitory. However such volatility will not disguise the fact that underlying consumer confidence in Australia remains consistently low.

While markets were volatile there was no net movement in the Australian share market between the June and July survey periods. However the Australian dollar did fall from around USD 0.77 to around USD 0.75

Further evidence that this headline impact from overseas news is unlikely to be sustained can be found in the response of households to the outlook for the unemployment rate. As readers will be aware we have been concerned for some time around the persistently elevated concerns that respondents have for the outlook for the jobs market. The Westpac Melbourne Institute Index of Unemployment Expectations actually fell 1.3% in the month indicating that slightly fewer consumers expect unemployment to rise. Households remain highly concerned about job prospects but the recent overseas developments did not exacerbate those concerns.

However we expect that it is very unlikely that the Board will decide to cut rates in August. In May it was still forecasting above trend growth in 2016 of 3.25% and we expect that the catalyst for any decision to cut rates would come from a substantial downward revision to its growth forecast for 2016 to 'below trend' territory. That decision will be largely influenced by the assessed momentum in the economy in the second half of this year and developments in the labour market. With insufficient available evidence on the former and, for now, the unemployment rate having stabilised there is almost no case for an August move.

Despite current market expectations we would also put a limited chance of a move in November. In fact we are comfortable to retain the view that rates will remain on hold for the remainder of this year and throughout 2016.

Australia's Westpac–MI Consumer Sentiment Index falls further

Wednesday, July 15, 2015 1:01 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022