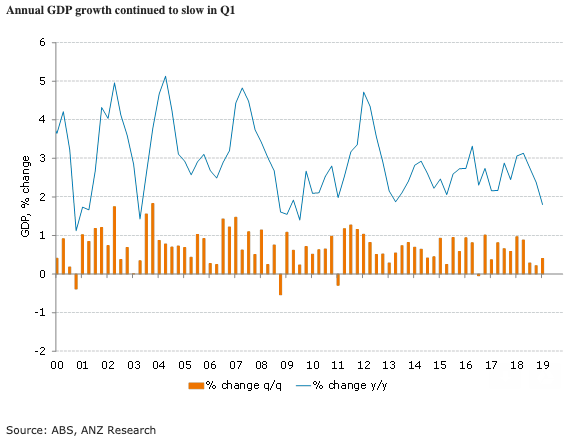

Australia’s gross domestic product (GDP) for the first quarter of this year picked up a little in Q1 to 0.4 percent q/q, although annual growth continued to slow and is now down to 1.8 percent, its slowest pace since 2009 in the midst of the global financial crisis.

Growth continues to be held down by a weak household sector, although business investment and exports are hardly strong. The public sector is certainly doing its bit to support growth, contributing 1.3ppt to the 1.8 percent growth over the past year.

The result looks to be less than the average 0.6-0.7 percent q/q growth the RBA had expected for Q1 and Q2, and suggests that another round of growth downgrades are likely in the Bank’s August Statement on Monetary Policy.

The report shows that weakness in the economy has become more broad-based, and the supports to growth more narrow.

The household sector remains under pressure, with weak income growth and falling house prices weighing on both consumer spending (+0.3 percent q/q) and housing construction (-2.5 percent q/q).

Interestingly, household consumption growth was strongest in NSW and Victoria where house price declines have been the largest, suggesting that income growth is the main driver of weakness.

"The weak tone to GDP confirms the dovish stance taken by RBA Governor, Phil Lowe, but the Bank is likely to be disappointed yet again by these results," ANZ Research commented in its latest report.

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions