Australia’s CAPEX for the first quarter of this year is expected to post a mild increase of 1.2 percent q/q, an encouraging result after four consecutive quarterly declines. Buildings and structures investment is likely to rise slightly, in line with last week’s data showing that business construction had nudged higher.

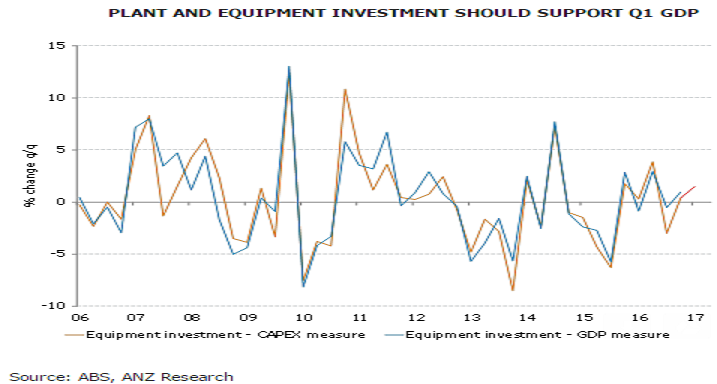

The most important part of the Q1 result is the investment in plant and equipment (P&E), which flows directly into GDP and it is expected to rise 1.5 percent q/q, given solid capital goods imports in the quarter. This is likely to be one of the few positive notes in next week’s GDP report, where the Q1 growth of is seen at just 0.1 percent q/q, ANZ Research reported.

Encouragingly, non-mining investment in 2017-18 is expected to be revised higher to AUD58 billion, implying a 5.7 percent y/y rise, compared to the anticipated 3.7 percent y/y rise reported last quarter. This stronger outlook comes in line with an improved business environment, with reported trading conditions, confidence and profitability all sitting around the highest levels since the global financial crisis.

"Looking ahead, we anticipate that firms will revise higher their estimate for CAPEX in 2017-18. ANZ’s raw estimate forecast of AUD88 billion would imply (after allowing for firms’ historical misses at this early stage) a 3.6 percent y/y fall in total CAPEX, although this is still significantly hindered by the mining sector," the report added.

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality