Fourth consecutive quarter the annual rate has slowed.

First there is some seasonality in the data and Q1 tends to be the second-weakest quarter, hence the modest quarterly gain.

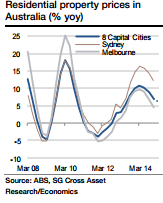

Second, at 0.9%, the gain would be quite solid given the average 0.6% qoq Q1 gain over the past ten years (median and mean) during which time average annual property price inflation averaged 5.1% - it's just that the Q1 2014 gain of 1.4% qoq was the second-largest Q1 gain in the past 11 years. Perhaps most importantly, at 6.3% yoy real estate inflation would remain very strong, regardless of the slowdown.

Sydney's house prices gains are likely to have remained 'crazy' as RBA governor Glenn Stevens called them, and probably accelerated, whereas the ones with the least momentum (Darwin, Hobart, Perth) are likely to have weakened further.

Perhaps most importantly, after the RBA cumulative 50bp rate cut this year, the risk is that property price inflation will pick up in coming quarters.

Australia's House price boom probably faded in Q1, but may pick up steam again

Monday, June 22, 2015 11:28 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed