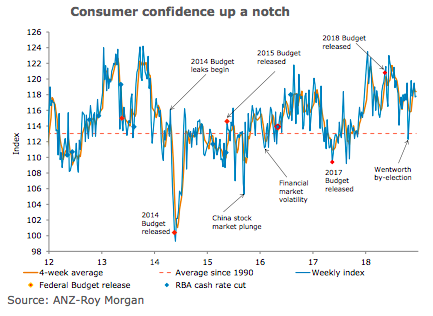

ANZ-Roy Morgan Australian Consumer Confidence was essentially unchanged last week, rising just 0.1 percent. Current financial conditions were down 2 percent, while future financial conditions were flat for the week.

Economic conditions readings were mixed, with current economic conditions up 0.2 percent while future economic conditions lost 0.9 percent. The ‘time to buy a household item’ gained the most among the sub-indices, rising 2.7 percent. Four-week moving average inflation expectations were up by 0.1 ppt at 4.3 percent.

In this final survey for the year, consumer sentiment finished well above average, though below the highs of earlier in the year. It is a touch higher than at the end of 2017. Not a bad outcome, given that households have faced a barrage of negative news in recent months about the state of the housing market and what it might mean for the economy.

"It seems there are sufficient offsets to this news; among them, a still robust labour market. The November employment report on Thursday will tell us just how robust, though we always caution against reading too much into what can be a volatile data series," said David Plank, ANZ’s Head of Australian Economics.

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality