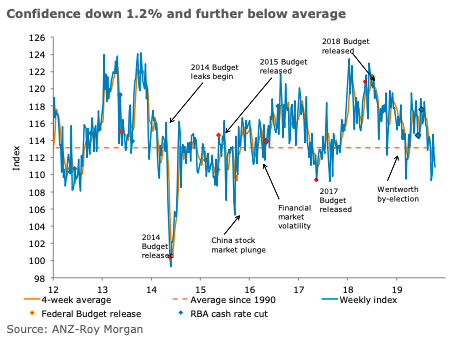

Australia’s ANZ Roy Morgan consumer confidence index was down 1.2 percent last week, its second straight weekly loss – ensuring confidence remains below its long-run average.

The financial conditions sub-indices were positive. Current finances gained 0.2 percent, while future finances were up 0.7 percent. These small gains coming after large falls last week.

In contrast weakness in the economic conditions sub-indices continued for a second week. Current economic conditions fell 1 percent, while future economic conditions lost 1.7 percent.

The ‘Time to buy a household item’ measure fell 3.9 percent after two successive gains. Inflation expectations (IE) remained stable at 4.1 percent.

"Consumer confidence was down 1.2 percent last week, despite some positive developments in the US-China trade war. The decline leaves overall sentiment below average. Household perceptions of the economic outlook fell for a second consecutive week and are well below average. It will be interesting to see whether economic sentiment can gain this week as households have more time to consider the news on trade. In contrast to the negative economic outlook, households remain much more confident about their own financial outlook. This week’s employment data could be important in this regard. Stable inflation expectations, albeit at a low level by historical standards, will be comforting for the RBA," said David Plank, ANZ’s Head of Australian Economics.

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains