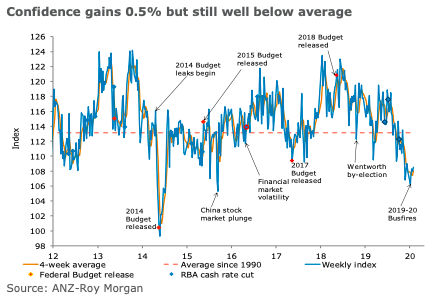

Australia’s ANZ-Roy Morgan consumer confidence edged up a touch last week, reversing the prior week’s decline, remaining well below average. Overall financial conditions were little changed, with offsetting moves in ‘current’ and ‘future’ finances.

Further ‘Current economic conditions’ gained 2.1 percent, while ‘future economic conditions’ declined 2.5 percent last week.

‘Time to buy a major household item’ gained 2.7 percent compared to a decline of 2.4 percent previously. The four-week moving average of ‘inflation expectations’ was up by 0.1ppt to 4.0 percent.

Meanwhile, the weekly reading rose to 4.2 percent, its highest level since early September, perhaps reflecting the lift in headline inflation reported in the December 2019 CPI report.

"Broadly stable consumer confidence in the face of news about the coronavirus, albeit at a level well below average, provides some comfort for the outlook. The decisive policy action taken the Government to protect the health and wellbeing of Australian citizens may be seen as a positive development that provides at least some offset to community concerns about the health and economic consequences of the virus. The coming week will be dominated by RBA commentary and some key data, not least the December retail sales figure, which is expected to confirm weak Christmas spending," said David Plank, ANZ’s head of Australian Economics.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  UK Housing Market Gains Momentum in Early 2026 as Mortgage Rates Fall

UK Housing Market Gains Momentum in Early 2026 as Mortgage Rates Fall  Starmer’s China Visit Signals New Era in UK–China Economic Relations

Starmer’s China Visit Signals New Era in UK–China Economic Relations  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Asia Stocks Pause as Tech Earnings, Fed Signals, and Dollar Weakness Drive Markets

Asia Stocks Pause as Tech Earnings, Fed Signals, and Dollar Weakness Drive Markets  China Factory Activity Slips in January as Weak Demand Weighs on Growth Outlook

China Factory Activity Slips in January as Weak Demand Weighs on Growth Outlook  Oil Prices Hit Four-Month High as Geopolitical Risks and Supply Disruptions Intensify

Oil Prices Hit Four-Month High as Geopolitical Risks and Supply Disruptions Intensify