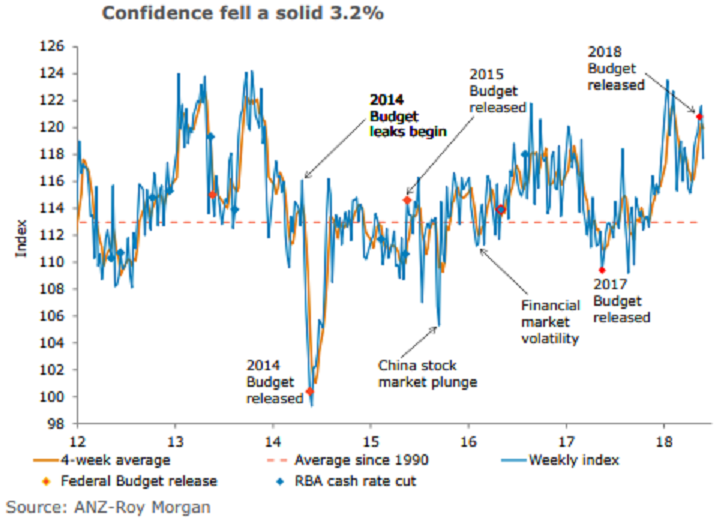

Australia’s ANZ-Roy Morgan consumer confidence dropped 3.2 percent last week to 117.7, after six straight weekly gains. The details were also negative with confidence falling across all sub-indices, led by a sharp fall in views towards future financial conditions.

Households’ views towards current financial conditions fell 2.7 percent last week entirely reversing gains over the previous two weeks. Views towards future financial conditions fell 4.1 percent to 122.5, the lowest since November last year.

Sentiment around current economic conditions eased 2.4 percent last week following no change previously. Views towards future economic conditions fell 2.5 percent last week, adding to the 1.9 percent loss in the previous week.

The 'time to buy a household item' sub-index dropped 3.9 percent last week, more than reversing the previous week’s rise (2.6 percent). The weekly inflation expectations climbed sharply to 4.7 percent.

"The fall in views towards financial conditions is a little worrying, however. This could reflect homeowners’ concerns about falling house prices, particularly in Sydney and Melbourne. Moreover, these concerns are likely exacerbated by the high existing household debt level and expectations of lacklustre wage growth in the near future. That said, despite the recent decline, views towards both current and future financial conditions remain above their long-term averages," said David Plank, head of Australian Economics, ANZ Research.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record