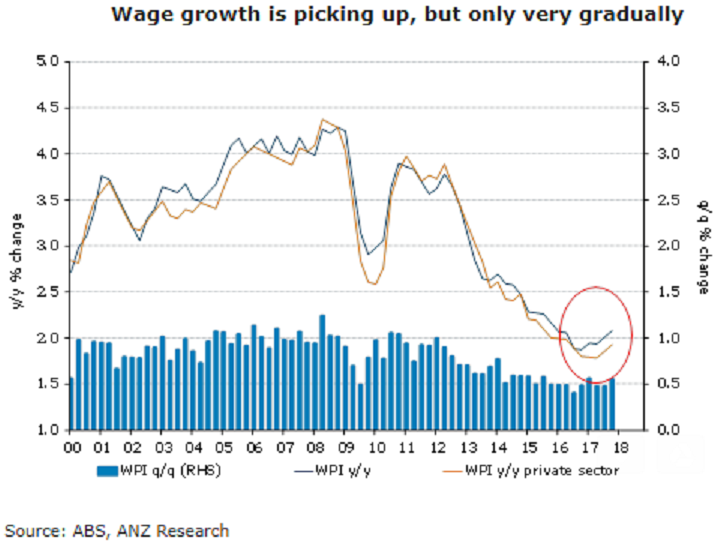

Australia’s wage growth finally looks to be picking up, posting the first upward surprise since Q4 2013. The strength was concentrated in public sector wages but some catch-up in private wages in Q1 this year is expected as well.

The wage price index (WPI) rose by 0.6 percent q/q and 2.1 percent y/y in Q4. This was a touch stronger than expectations, and the first positive surprise for the market since Q4 2013. The strength was driven by public sector wages, which grew 0.6 percent; while the private sector's WPI rose 0.5 percent in line with the previous three quarters. The annual rate of growth in private wages remained unchanged at 1.9 percent.

However, the finalization of a number of delayed enterprise bargaining agreements late last year suggests some upside risks for both retail and overall private sector wages in Q1. More broadly, spare capacity in the labour market is gradually being eroded, job security has improved and businesses are reporting some pockets of difficulty in finding suitable labour.

"The RBA is likely to be comfortable with the data, although we expect that, like us, it would be hoping for some improvement in private wage growth in Q1," ANZ Research commented in its latest report.

Meanwhile, RBA Governor, Philip Lowe, in his semi-annual testimony to parliament on February 16 noted, "if we're going to deliver average inflation of 2-1/2 percent we should probably have average wage increases over long periods of time at 3-1/2 percent".

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient