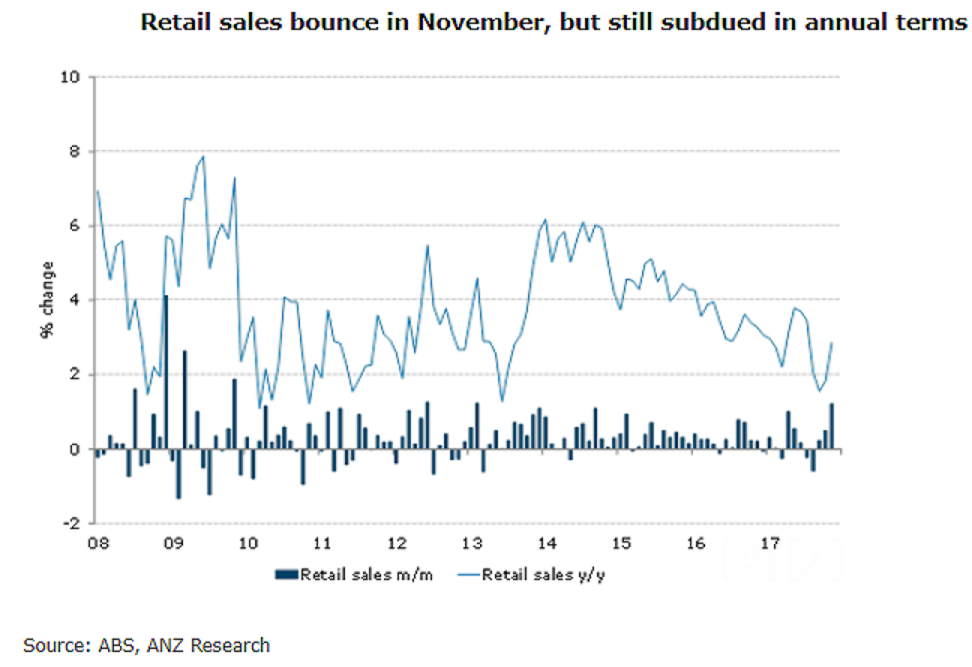

Australia’s retail sales for the month of November recorded its strongest monthly rise since a similar gain in February 2013, underpinned by the release of the iPhone X and increasing popularity of Black Friday and associated sales. However, the figures have largely shrugged-off the jump in petrol prices for the month, which was thought to dampen the sales relative to the consensus expectation.

Retail sales were up 1.2 percent m/m in November, building on the 0.5 percent m/m gain for October, and seeing annual growth at 2.9 percent y/y, the best result since July 2017. Categories impacted by these are household goods (up 4.5 percent m/m, with the electrical and electronic sub-category up 9.3 percent m/m) and other retailing (+2.2 percent m/m).

Interestingly, housing-related spending bounced despite still-slowing house price growth, with sales of furniture, floor coverings, houseware and textiles up 1.2 percent m/m, and hardware, building and garden supplies up 1.8 percent m/m. The strength in clothing sales was also noteworthy (up 2.2 percent m/m), although likely also boosted by the November sales. In contrast, department store sales disappointed, falling 1.1 percent m/m, after a solid run over the past three months.

"The strength in November builds on the solid gain for October and suggests that retail sales will be solid for the December quarter as a whole. We don’t think this changes the story of a challenging retail environment, with soft demand for the most part and competitive forces weighing on prices," ANZ Research commented in its latest report.

Meanwhile, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed