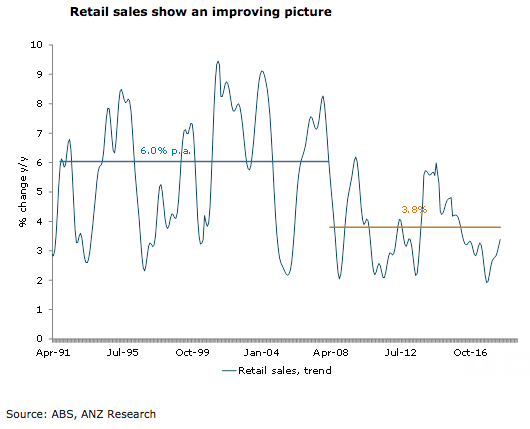

Australia’s retail sales bounced back during the month of August, with the strength broadly based across the country and across categories. While this is consistent with ANZ-Roy Morgan consumer confidence, which continues to track above its long run average, it is somewhat surprising in the face of falling house prices, rising petrol prices and ongoing retail price deflation.

Retail sales bounced back, rising 0.3 percent m/m in August after a flat outcome the previous month, which pushes annual growth up to 3.8 percent y/y, the fastest pace since May 2017. In three month end annualised terms, retail sales are up a solid 5.3 percent.

The strength in sales was broadly based across the country and across categories. Sales rose in every state except the Northern Territory, and were particularly strong in New South Wales (+0.5 percent m/m), South Australia (+0.7 percent m/m) and Tasmania (+0.6 percent m/m). Sales in New South Wales and Victoria remain very solid, up 4.3 percent y/y and 5.9 percent y/y respectively.

Food sales were flat in August, while every other category recorded a rise. This was led by department store sales (+0.9 percent m/m), with strong growth also in clothing & footwear (+0.8 percent m/m) and cafes, restaurants & takeaway (+0.7 percent m/m).

Household goods sales rose a more modest 0.2 percent m/m, but this was weighed down by a 0.5 percent fall for electrical and electronic goods sales. Furniture, floor covering, houseware and textile goods sales were up a solid 1.1 percent.

Adding to the positive tone, large store sales – which tend to be less volatile given the data is enumerated rather than survey based - rose 0.5 percent m/m, to be 5 percent higher over the year, while small store sales fell by 0.1 percent m/m (to be up 1.2 percent y/y). Online retail sales continue to gain share, accounting for 5.6 percent of sales in August, up from 4.6 percent a year ago.

"Given we see consumer spending as a key risk to the economic outlook, the current resilience in household spending – despite the various headwinds - is encouraging and sets a solid base for Q3 consumption," ANZ Research commented in its latest report.

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality