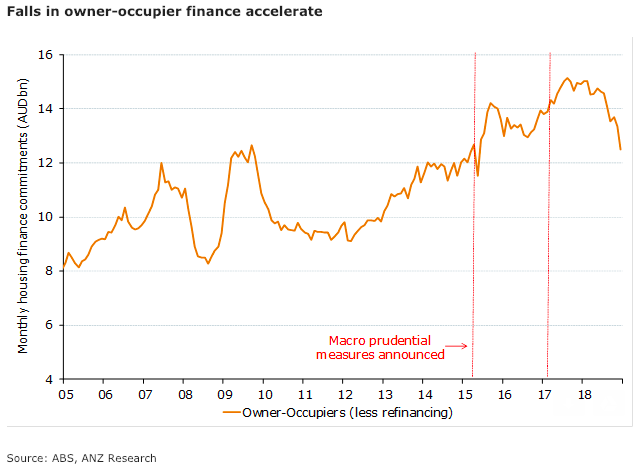

Australia’s housing finance continued to fall in December, with the largest falls seen for owner-occupiers. Finance for first home buyers, which had previously outperformed other segments, fell sharply in December.

Total financing is down 20 percent over the last year, and further falls are likely in the near term. A sustained improvement in housing finance would be an early indicator of a stabilisation in the housing market.

The value of housing finance commitments fell at a faster rate in December. Finance approvals are now 20 percent lower over the year. Further declines are likely as tighter lending standards continue to filter through, ANZ Research reported.

The value of finance for owner-occupiers fell 6.4 percent m/m, leaving it 16.2 percent lower for the year. Investor finance fell 4.6 percent in the month and is 27.8 percent lower year on year.

Within the owner-occupier category, the trend of first home buyer outperformance has ended, as it declined 8 percent m/m. As a share of the value of total housing finance (excluding refinancing), first home buyers were 16 percent, down from 17 percent in November. It appears that tighter lending standards are now affecting this segment.

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran