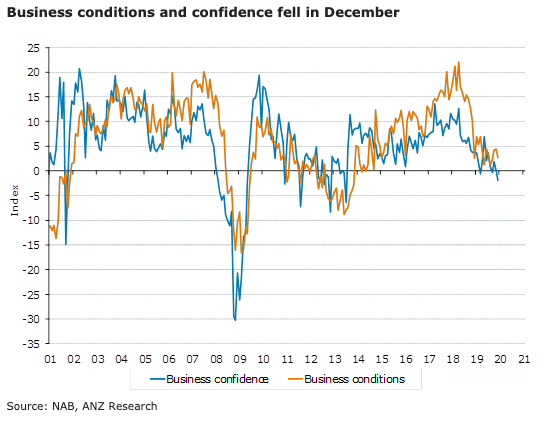

Australia’s business conditions fell 1.6pts to +2.7 in December to be 3.0pts below the long-run average. Business confidence was even more disappointing, falling to -1.9. This was the weakest result since July 2013, ANZ Research reported.

The employment index was fairly stable at +4.2 and remains the standout component at 2.2pts above its long-run average. Forward orders improved 0.9pts, albeit not enough to get back into positive territory.

Capacity utilisation was down 0.2ppts to 80.9 percent. Profitability fell 2.5pts from its November eight-month high, while trading also fell 1.5pts. The fall in confidence in December was led by retail and construction, although conditions actually improved in both industries during the month.

Business conditions also improved in mining, manufacturing, wholesale trade and recreation and personal services. It appears that the 16.0pt drop in conditions in finance, business and property services drove most of the overall decline.

Meanwhile, Queensland (up 1.4pts) was the only state to record an improvement in business conditions in December. Western Australia (down 6.6pts), Tasmania (down 6.2pts) and Victoria (down 3.8pts) saw the largest declines.

"We expected that bushfires, smoke haze and a weaker Christmas shopping season could have had a negative effect, but NAB indicated that the impact of the bushfires may not yet be apparent in the results. NAB has previously warned that caution should be taken when interpreting the data around the Christmas/New Year period. We will look to the January survey due out in two weeks to get a better idea of the underlying momentum," ANZ Research further commented in the report.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility