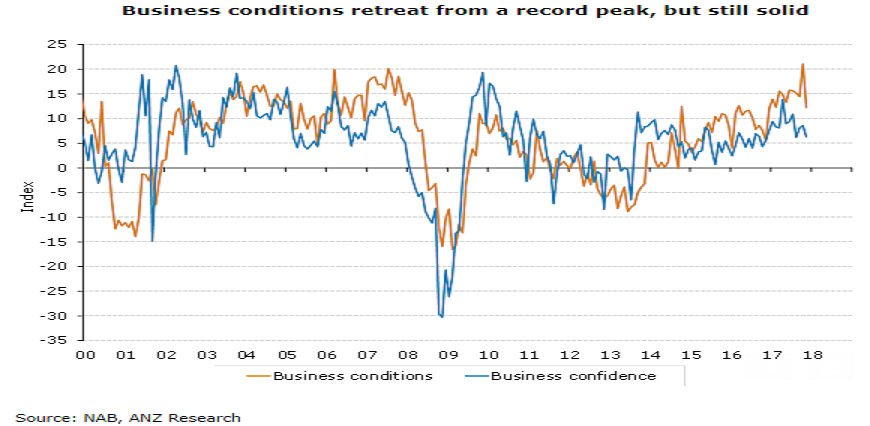

Australian business conditions fell sharply in November, but this should be viewed in the context of a retreat away from the all-time record level reached in October. Conditions still look fairly solid and continue to bump around the best levels since the GFC.

On the other hand, business confidence fell again and has been trending lower for the past six months. The persistent divergence between business conditions and business confidence perhaps suggests that businesses have been surprised by the current strength of the economy. The decline in confidence is not ideal, but historically we have seen that reported conditions are the better leading indicator of movements in the real economy.

A breakdown of the conditions data supports this ‘still optimistic but slightly less so’ view. Reported profitability fell significantly in the month, although again this likely reflects some payback from the previous month’s sharp rise.

Capacity utilization is less prone to sudden movements, and the stalling of the previous trend improvement is noteworthy. Capacity utilization is a useful leading indicator of the labour market (Figure 3), and recent results suggest that we have already seen much of the likely decline in the unemployment rate.

"Having said this, other indicators, such as profitability, point toward solid levels of ongoing employment growth," ANZ Research commented in its latest report.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election