Australia’s business conditions fell again in October, from a downwardly-revised September result. This meant that conditions are now at the lowest level since November 2016.

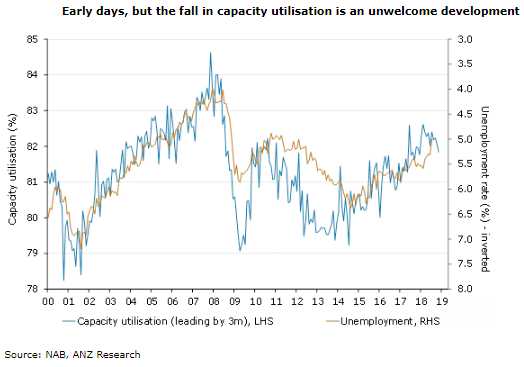

The details of the report were soft across the board. The two key components that give us a read on the labor market were down, with capacity utilization slipping to the lowest level in a year and profitability the lowest in two years. The drop in capacity utilization, in particular, is disappointing.

This had previously signaled that the labor market was in good shape, and markets have subsequently seen the unemployment rate fall to 5.0 percent. While only a very gradual fall in the unemployment rate was expected from here, further drops in capacity utilization would be cause for concern that unemployment could head back up from here.

Weakness in business conditions was evident across most industries, but the decline in the finance, business and property segment stands out. Conditions in the sector are now at the lowest level since 2015 and are well below the long-term average.

This is unsurprising given the weakness in the housing market and the ongoing impact of the Royal Commission. In brighter news, the construction sector bucked the trend in October with a solid increase in conditions, likely supported by the many infrastructure works across the country.

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility