Australian stock index ASX 200, is trading at 5946, as of today up close to 10% YTD. However it is yet to reach its pre-crisis high.

- European Central Bank's (ECB) asset purchase program, will lead money towards regions other than Euro zone, namely develop economies such as UK, Australia, New Zealand as well as towards developing economies.

Australian stock market has remained weak in comparison to global peers facing headwinds from slower economy and lower commodity prices affecting Australia's mining sector.

- Weak economy and government led deficit reduction will see Reserve bank of Australia (RBA) to keep monetary policies loose.

- Moreover Australia's diversification in commodity business and customers such as providing LNG to Japan will help in the long run and benefit the banking sector a lot.

Current indicators show, despite economic headwinds Australia's economy might be turning the corner.

- National Australia Bank's business confidence rose to 3 from 0 in March. The survey indicator hasn't turned negative since august 2013.

- Business conditions rose to 6 from 2 in March, reached highest level since November last year.

Economic conditions according to the survey remains weak, however showing early signs of revival. Moreover Weaker Aussie with lower oil price will boost economy further.

- Since 2009 profitability of national banks have been going up steadily only hindered by 2011/12, Euro zone debt crisis. According to RBA, profits after tax are to go up further over 2015 and 2016.

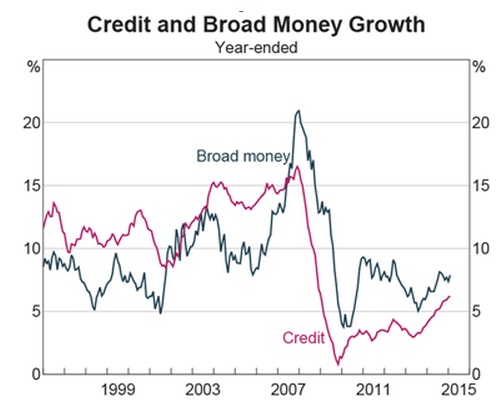

- Credit growth, which has gone close to zero in 2009 from its 16% pre-crisis high are showing signs of comeback. Credit growth now stands around 6% and rising steadily.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings