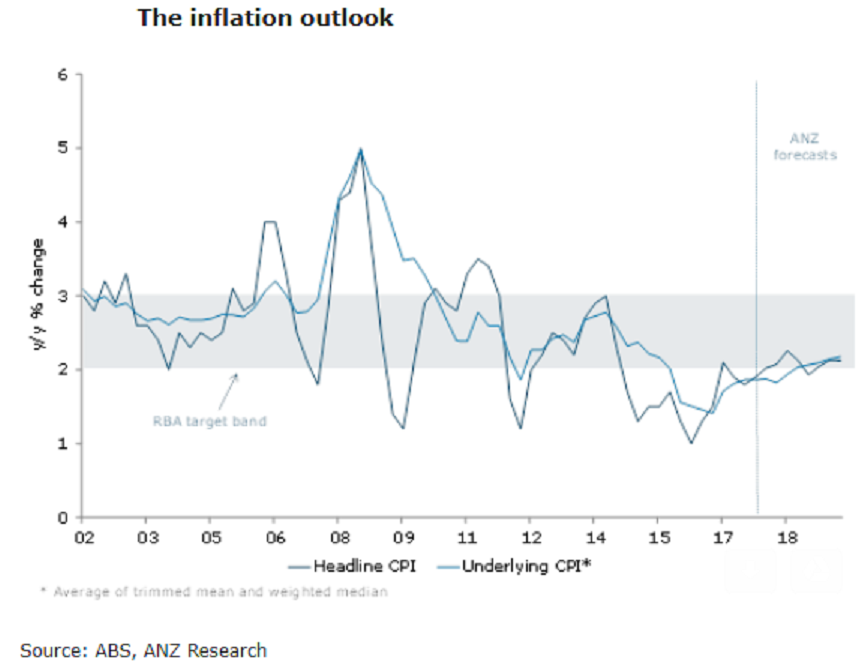

Australia’s consumer price inflation is expected to rise by 0.5 percent q/q for the first quarter of this year, with core inflation also rising by the same figure, according to a recent report from ANZ Research.

The country’s Q4 inflation print was a touch below expectations for the headline, at 0.6 percent q/q, but in line with market expectations for core, with a 0.4 percent q/q rise for both the weighted median and trimmed mean.

Overall, it was a solid result, particularly given the drag from the re-weighting. There were few surprises in the data, with headline boosted by fuel, tobacco, domestic travel, and fruit. The retail competition was still evident with a range of retail prices falling in the quarter. Overall the data suggest that inflationary pressures have stabilized just below the policy band and should rise gradually over time.

"We see this data as consistent with our view that the RBA will look to raise rates this year, with a focus on bringing the real cash rate back to zero. We continue to look for the first of two rate hikes in May, although this is based on our forecast that the WPI prints a 0.5 percent q/q rise for Q4 on 22 February," the report added.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election